We are very close to the end of Minor wave 2 up, with the top around a week in the future. Expectations for a three month long reprieve period were fulfilled as markets made a rapid bounce off the early October 2011 lows and then stayed elevated for the rest of the year. It was a chance for people to enjoy the holidays while the economic and financial fault lines in the western world were temporarily stabilized.

As we approach the end of the three month reprieve period, the mainstream media has become extremely bullish. Expectations for economists, market analysts, and journalists in the mainstream media to become very bullish on the economy, job market, and stock market by the end of the year have been fulfilled. Since the last write-up in early December 2011 as the last part of Minor wave 2 up started unfolding, people have become even more bullish on the economy, stock market, and job market.

Here are some recent examples of extreme bullishness that has shown up in the mainstream media in the last few days:

1 -- Yahoo news uses the rising consumer confidence as a reason to be bullish on the economy in 2012, even though the long term trend of lower highs and lower lows in consumer confidence since the peak in 2000 is still intact.

2 -- Journalists working for MSNBC are extremely bullish on the US economy, making calls for the economy and job market to grow faster in 2012. This bullishness is also shared by virtually all the mainstream economists as well, who are all calling for increased economic growth.

3 -- Douglas Kass (well known investor) is extremely bullish on the stock market, making bold calls for new all time highs by the end of 2012. The video of the interview on CNBC can be seen here.

4 -- On the Kudlow Report yesterday on CNBC, there was abundant talk about stocks being "ridiculously cheap", which indicates extreme bullishness. Video of the news segment is here.

From a socionomic perspective, extremes in social mood signal a reversal of the current trend. Combined with our current position of being near the end of Minor wave 2 up, there is a strong reason to anticipate an imminent reversal in the stock market.

The DJIA continues to follow the 1930s parallel with the third phase of "The Great Deflation" being a parallel of the Great Depression. Here are some updated charts of the DJIA underscoring the parallel:

DJIA in 1929 - 1930:

DJIA in 2009 - 2012:

Notice that both of the bear market rallies put in a head and shoulders top. In both cases, the head and shoulders top formed with fibonacci relationships in terms of time with a fibonacci convergence at the right shoulder.

In the bear market rally that unfolded in 1930:

1 -- The right shoulder peak formed 1.5 months (3 time units) after the peak of the head.

2 -- The peak of the head formed 2.5 months (5 time units) after the peak of the left shoulder.

3 -- The left shoulder and the right shoulder are 4 months (8 time units) apart.

4 -- The right shoulder peak formed 6.5 months (13 time units) after the start of the bear market rally in November 1929.

Notice the fibonacci sequence numbers 3 - 5 - 8 - 13 in the head and shoulders top.

In the bear market rally that unfolded in 2009 - 2012:

1 -- The right shoulder peaked 8 months after the head peaked.

2 -- The head peaked 13 months after the left shoulder peaked.

3 -- The left shoulder and the right shoulder are 21 months apart.

4 -- The right shoulder peaked 34 months after the start of the bear market rally.

Notice the fibonacci sequence numbers 8 - 13 - 21 - 34 in the head and shoulders top.

The sentiment in both of the bear market rallies is also identical as well. In both cases, economists, politicians, and the mainstream media were extremely bullish on the economy by the end of the bear market rally, with assurances from politicians and the mainstream media that the worst was over.

Here is a chart of the 1930 bear market rally with our current equivalent position arrowed on the chart:

We are currently at the equivalent of late May 1930. We are close to the end of Minor wave 2 up. After the reprieve period ends, Minor wave 3 down will start and is expected to take the form of a waterfall decline in the stock market with a duration of 4 months. The start of Minor wave 3 down is when the economy and stock market enters the heart of the abyss with "The Great Deflation" unfolding in full force, in the same way that the economy, stock market, and job market entered the heart of the abyss in early June 1930 during the Great Depression.

The downside target for the end of Minor wave 3 down is 7200 on the DJIA and 775 on the S&P 500, both to be reached in May 2012.

Wednesday, December 28, 2011

Wednesday, December 21, 2011

Precursors of the Great Tribulation Climax

The bear market is already bringing back the fear of a future conflict between the United States and Russia even as the climax of the tensions between the two countries is still over 40 years in the future. The precursors are currently small and trivial as we are still in the early part of the Grand Supercycle degree bear market.

After the Cold War ended in 1991, rising social mood had kept the tensions between the United States and Russia at bay. The Cold War started in 1946 in the immediate aftermath of World War II. The end of the Cold War corresponds with the beginning of Primary wave [5] of Cycle wave V (1974 - 2000) up in the S&5 500 index. Although the Cold War persisted for 45 years, the most significant events unfolded during the largest social mood declines:

1 -- Primary wave [2] of Cycle wave III (1942 - 1966) up is associated with the Berlin Blockade, the Marshall Plan, and the Czechoslovak coup d'etat.

2 -- Primary wave [4] of Cycle wave III (1942 - 1966) up is associated with the Cuban Missile Crisis.

3 -- Cycle wave IV (1966 - 1974) down is associated with the Prague Spring and the subsequent Warsaw Pact invasion of Czechoslovakia. A short time later, the Soviet Union introduced the Brezhnev Doctrine to justify putting an end to democratic liberalization efforts in the Eastern bloc.

4 -- Primary wave [2] of Cycle wave V (1974 - 2000) up is associated with the Soviet invasion of Afghanistan and the Reagan Doctrine in which Ronald Reagan labelled the Soviet Union as an "Evil Empire".

The Cold War also resulted in an arms race in which both the United States and the Soviet Union bolstered their nuclear weapons arsenals, and it resulted in a number of proxy wars in the third world.

The bear market is already bringing back the fear of a future conflict between the United States and Russia. The developments are trivial, but they likely foreshadow what is yet to come:

1 -- The popular video game Call of Duty : Modern Warfare 3 revolves around the story of an armed conflict between the United States and Russia in 2016 - 2017.

2 -- The movie Mission Impossible : Ghost Protocol also revolves around a conflict between the United States and Russia.

The United States is not the only country on the planet that is expanding its military-industrial complex. Russia is also modernizing its military capabilities as well, which could easily foreshadow future tensions between the United States and Russia in the future. The latest development is Russia working on a monster missile in response to US missile defense plans.

Bear markets of Supercycle degree and above always result in a war, an a 4000+ year historical perspective bears this out. Wars are associated with the largest "C" waves in a bear market, which in the case of the current bear market, would be "The Great Tribulation" (Supercycle wave (c)). The current bear market will result in World War III, which will start during Supercycle wave (c) of Grand Supercycle wave [IV]. During that time, both the United States and Russia will be in a state of war -- for the United States, it will be about the war on terror, for Russia, it will be about reclaiming lost territory and bringing back the Soviet Union and the Warsaw Pact. It is very likely that Iran will be the flash point that causes extreme tension between the two nations as Iran is allied with Russia.

It is perhaps very fortunate that the bear market isn't larger than Grand Supercycle degree. A Millennium degree bear market would have resulted in a limited nuclear exchange between the United States and Russia, with a 5 - 20 year nuclear winter to follow. A Super Millennium degree bear market would have resulted in a full scale nuclear exchange between the United States and Russia, causing a nuclear holocaust and a nuclear winter lasting 100+ years.

As "The Great Tribulation" reaches its climax, the bear market is expected to result in extreme tensions between the United States and Russia with the most dangerous game of chicken in the history of human civilization creating a global atmosphere of debilitating fear. The fear of an armed conflict will reach its climax in the 2052 - 2060 time frame as the bear market low point approaches. One can imagine the news in the mainstream media and the political world in 2055:

"A war between the United States and Russia is the harbinger of a new dark age for human civilization"

There will be a lot of tough talk, a lot of aggressive posturing, and a lot of saber rattling between the two nations during the last part of "The Great Tribulation", but no actual conflict is expected to take place.

After the Cold War ended in 1991, rising social mood had kept the tensions between the United States and Russia at bay. The Cold War started in 1946 in the immediate aftermath of World War II. The end of the Cold War corresponds with the beginning of Primary wave [5] of Cycle wave V (1974 - 2000) up in the S&5 500 index. Although the Cold War persisted for 45 years, the most significant events unfolded during the largest social mood declines:

1 -- Primary wave [2] of Cycle wave III (1942 - 1966) up is associated with the Berlin Blockade, the Marshall Plan, and the Czechoslovak coup d'etat.

2 -- Primary wave [4] of Cycle wave III (1942 - 1966) up is associated with the Cuban Missile Crisis.

3 -- Cycle wave IV (1966 - 1974) down is associated with the Prague Spring and the subsequent Warsaw Pact invasion of Czechoslovakia. A short time later, the Soviet Union introduced the Brezhnev Doctrine to justify putting an end to democratic liberalization efforts in the Eastern bloc.

4 -- Primary wave [2] of Cycle wave V (1974 - 2000) up is associated with the Soviet invasion of Afghanistan and the Reagan Doctrine in which Ronald Reagan labelled the Soviet Union as an "Evil Empire".

The Cold War also resulted in an arms race in which both the United States and the Soviet Union bolstered their nuclear weapons arsenals, and it resulted in a number of proxy wars in the third world.

The bear market is already bringing back the fear of a future conflict between the United States and Russia. The developments are trivial, but they likely foreshadow what is yet to come:

1 -- The popular video game Call of Duty : Modern Warfare 3 revolves around the story of an armed conflict between the United States and Russia in 2016 - 2017.

2 -- The movie Mission Impossible : Ghost Protocol also revolves around a conflict between the United States and Russia.

The United States is not the only country on the planet that is expanding its military-industrial complex. Russia is also modernizing its military capabilities as well, which could easily foreshadow future tensions between the United States and Russia in the future. The latest development is Russia working on a monster missile in response to US missile defense plans.

Bear markets of Supercycle degree and above always result in a war, an a 4000+ year historical perspective bears this out. Wars are associated with the largest "C" waves in a bear market, which in the case of the current bear market, would be "The Great Tribulation" (Supercycle wave (c)). The current bear market will result in World War III, which will start during Supercycle wave (c) of Grand Supercycle wave [IV]. During that time, both the United States and Russia will be in a state of war -- for the United States, it will be about the war on terror, for Russia, it will be about reclaiming lost territory and bringing back the Soviet Union and the Warsaw Pact. It is very likely that Iran will be the flash point that causes extreme tension between the two nations as Iran is allied with Russia.

It is perhaps very fortunate that the bear market isn't larger than Grand Supercycle degree. A Millennium degree bear market would have resulted in a limited nuclear exchange between the United States and Russia, with a 5 - 20 year nuclear winter to follow. A Super Millennium degree bear market would have resulted in a full scale nuclear exchange between the United States and Russia, causing a nuclear holocaust and a nuclear winter lasting 100+ years.

As "The Great Tribulation" reaches its climax, the bear market is expected to result in extreme tensions between the United States and Russia with the most dangerous game of chicken in the history of human civilization creating a global atmosphere of debilitating fear. The fear of an armed conflict will reach its climax in the 2052 - 2060 time frame as the bear market low point approaches. One can imagine the news in the mainstream media and the political world in 2055:

"A war between the United States and Russia is the harbinger of a new dark age for human civilization"

There will be a lot of tough talk, a lot of aggressive posturing, and a lot of saber rattling between the two nations during the last part of "The Great Tribulation", but no actual conflict is expected to take place.

Saturday, December 17, 2011

Increasing Political Gridlock Ahead

There existed the possibility that the Republicans and Democrats would briefly have a reluctant willingness to compromise during the last part of Minor wave 2 up as positive social mood results in compromise and consensus. We are indeed seeing a last willingness by Republicans and Democrats to compromise on government spending before "The Great Deflation" starts unfolding in full force.

It is significant that President Obama only managed to garner an agreement in Congress for a 2 month stopgap extension in extended unemployment benefits and a payroll tax cut in spite of over a month of hardcore campaigning on the payroll tax extension issue. This is in strong contrast to December 2010 where President Obama managed to hammer out an agreement for extended unemployment benefits and a payroll tax cut to be extended for a full year (all of 2011). The reason for the difference in outcome has to do with the social mood trends -- in December 2010, we were still in Primary wave [2] up, so the social mood at that time made it easier for President Obama to hammer out a deal with the GOP. We are now almost 8 months into Primary wave [3] down, and positive social mood at the peak of Minor wave 2 up (within a much larger Primary degree decline) was never going to achieve the lofty levels that were reached at the peak of Primary wave [2] up.

The difference in outcome between now and December 2010 underscores a fundamental aspect of bear markets -- as bearish social mood increases, so does strife and discord in the political arena, making it progressively harder for politicians to compromise and reach an agreement on various issues.

The next extension will go for a vote in Congress in late February 2012. By then, Minor wave 3 down will be well underway. Here is a chart of the DJIA with the events labelled:

When the next vote takes place, we will be in Minute wave [iii] of Minor wave 3 down with the Intermediate degree point of recognition close at hand. Given the bearish social mood that will be present at that time, there will be too much strife and discord to make any type of agreement possible, effectively putting an end to the payroll tax cuts and extended unemployment benefits on March 1, 2012. With Congress also due to hammer out a federal budget around that time as well, the strife and discord in the political arena due to bearish social mood will make a government shutdown with a duration of several months a virtual certainty as Republicans refuse to budge on protecting the tax cuts for the top 1% and Democrats refuse to budge on raising taxes on the top 1%.

With Minor wave 3 down on the horizon, one of the defining characteristics of 2012 will be increasing political gridlock as the Republicans and the Democrats become increasingly stubborn, ultimately resulting in a federal government shutdown lasting several months.

It is significant that President Obama only managed to garner an agreement in Congress for a 2 month stopgap extension in extended unemployment benefits and a payroll tax cut in spite of over a month of hardcore campaigning on the payroll tax extension issue. This is in strong contrast to December 2010 where President Obama managed to hammer out an agreement for extended unemployment benefits and a payroll tax cut to be extended for a full year (all of 2011). The reason for the difference in outcome has to do with the social mood trends -- in December 2010, we were still in Primary wave [2] up, so the social mood at that time made it easier for President Obama to hammer out a deal with the GOP. We are now almost 8 months into Primary wave [3] down, and positive social mood at the peak of Minor wave 2 up (within a much larger Primary degree decline) was never going to achieve the lofty levels that were reached at the peak of Primary wave [2] up.

The difference in outcome between now and December 2010 underscores a fundamental aspect of bear markets -- as bearish social mood increases, so does strife and discord in the political arena, making it progressively harder for politicians to compromise and reach an agreement on various issues.

The next extension will go for a vote in Congress in late February 2012. By then, Minor wave 3 down will be well underway. Here is a chart of the DJIA with the events labelled:

When the next vote takes place, we will be in Minute wave [iii] of Minor wave 3 down with the Intermediate degree point of recognition close at hand. Given the bearish social mood that will be present at that time, there will be too much strife and discord to make any type of agreement possible, effectively putting an end to the payroll tax cuts and extended unemployment benefits on March 1, 2012. With Congress also due to hammer out a federal budget around that time as well, the strife and discord in the political arena due to bearish social mood will make a government shutdown with a duration of several months a virtual certainty as Republicans refuse to budge on protecting the tax cuts for the top 1% and Democrats refuse to budge on raising taxes on the top 1%.

With Minor wave 3 down on the horizon, one of the defining characteristics of 2012 will be increasing political gridlock as the Republicans and the Democrats become increasingly stubborn, ultimately resulting in a federal government shutdown lasting several months.

Wednesday, December 14, 2011

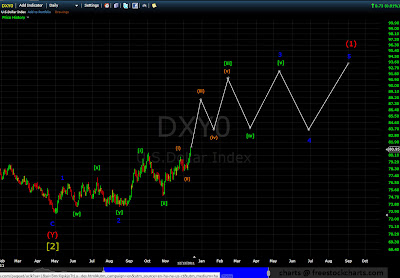

US Dollar Index Hits 11 Month High

The US Dollar Index reached an 11 month high, breaking through the 80 barrier yesterday and staying above that level today. The bulls are in firm control over the dollar even as "The Great Deflation" inexorably regains the upper hand in gold, oil, stocks, and housing after a 2 year bear market rally from March 2009 to May 2011.

Here is an updated chart of the US Dollar Index starting from the low of Primary wave [2] down (2008 - 2011) and the rally so far from the low:

The primary count is that the dollar is approaching the center of Intermediate wave (1) of Primary wave [3] up, which could explain the break-out advance that has started to unfold over the last month. This scenario is hinting that we are close to reaching an Intermediate degree point of recognition in which analysts and economists will start to realize that the dollar is trending upwards.

Here is a chart of the US Dollar Index since the low in 2008, which shows part of a Cycle degree advance in progress:

The upside target of Intermediate wave (1) of Primary wave [3] in the US Dollar Index is around 93, to be reached in September 2012. The upside target takes the dollar beyond the peak of Primary wave [1] up.

Here is a chart of the US Dollar Index, showing the projected wave path of the dollar through the rest of "The Great Deflation". The advance from the low in 2008 is Cycle wave I up, projected to end in 2021 with an upside target of around 185.

The US Dollar Index is an important part of "The Great Deflation" picture. While the US Dollar Index is in a bullish uptend, stocks, commodities, the economy, and job market are declining during the same time interval. Here is how the dollar fits into the overall picture:

1 -- The Cycle degree advance in the dollar from 2008 to 2021 lasts a fibonacci 13 years. The advance was preceded by a 32 year bearish ending diagonal. The 13 year duration for Cycle wave I up in the dollar also fulfills the guideline that ending diagonals are retraced in the opposite direction in one-third to one-half of the time. This strongly argues for "The Great Deflation" ending in 2021. Cycle wave I up in the US Dollar Index strongly corresponds to Cycle wave c down in the DJIA, S&P 500 and the Wilshire 5000.

2 -- Most of the global debt is denominated in US dollars. During the massive credit bubble that unfolded during Cycle wave V up (1974 - 2000), the dollar was relentlessly devalued relative to other currencies on the planet as the credit bubble expanded. At the height of the credit bubble, there was an estimated 1 quadrillion (that is 10^15) dollars in debt throughout the globe. Now that the credit bubble is imploding, the US dollar is rising in value again as phantom money (which is mostly dollars) disappears into thin air.

As "The Great Deflation" starts unfolding in full force, the US Dollar Index will accelerate upwards. Primary wave [3] up in the US Dollar Index strongly corresponds to Primary wave [3] down in the DJIA, S&P 500, and the Wilshire 5000. As we are approaching the center of Intermediate wave (1) of Primary wave [3] up in the dollar, the overall sentiment on the dollar in the mainstream media is something to keep an eye on in the coming weeks.

Here is an updated chart of the US Dollar Index starting from the low of Primary wave [2] down (2008 - 2011) and the rally so far from the low:

The primary count is that the dollar is approaching the center of Intermediate wave (1) of Primary wave [3] up, which could explain the break-out advance that has started to unfold over the last month. This scenario is hinting that we are close to reaching an Intermediate degree point of recognition in which analysts and economists will start to realize that the dollar is trending upwards.

Here is a chart of the US Dollar Index since the low in 2008, which shows part of a Cycle degree advance in progress:

The upside target of Intermediate wave (1) of Primary wave [3] in the US Dollar Index is around 93, to be reached in September 2012. The upside target takes the dollar beyond the peak of Primary wave [1] up.

Here is a chart of the US Dollar Index, showing the projected wave path of the dollar through the rest of "The Great Deflation". The advance from the low in 2008 is Cycle wave I up, projected to end in 2021 with an upside target of around 185.

The US Dollar Index is an important part of "The Great Deflation" picture. While the US Dollar Index is in a bullish uptend, stocks, commodities, the economy, and job market are declining during the same time interval. Here is how the dollar fits into the overall picture:

1 -- The Cycle degree advance in the dollar from 2008 to 2021 lasts a fibonacci 13 years. The advance was preceded by a 32 year bearish ending diagonal. The 13 year duration for Cycle wave I up in the dollar also fulfills the guideline that ending diagonals are retraced in the opposite direction in one-third to one-half of the time. This strongly argues for "The Great Deflation" ending in 2021. Cycle wave I up in the US Dollar Index strongly corresponds to Cycle wave c down in the DJIA, S&P 500 and the Wilshire 5000.

2 -- Most of the global debt is denominated in US dollars. During the massive credit bubble that unfolded during Cycle wave V up (1974 - 2000), the dollar was relentlessly devalued relative to other currencies on the planet as the credit bubble expanded. At the height of the credit bubble, there was an estimated 1 quadrillion (that is 10^15) dollars in debt throughout the globe. Now that the credit bubble is imploding, the US dollar is rising in value again as phantom money (which is mostly dollars) disappears into thin air.

As "The Great Deflation" starts unfolding in full force, the US Dollar Index will accelerate upwards. Primary wave [3] up in the US Dollar Index strongly corresponds to Primary wave [3] down in the DJIA, S&P 500, and the Wilshire 5000. As we are approaching the center of Intermediate wave (1) of Primary wave [3] up in the dollar, the overall sentiment on the dollar in the mainstream media is something to keep an eye on in the coming weeks.

Thursday, December 8, 2011

Socionomic Perspective on the 2012 GOP Primary

As we approach the end of 2011, all eyes are on the 2012 GOP primary election. On the Democratic side, it is very obvious that Barack Obama will win the Democratic Primary in a massive landslide, as it is very unlikely within the next few weeks that a progressive candidate will come forward to initiate a primary challenge. The GOP Primary is another matter altogether as it is still in a state of flux although some inferences can be made using the socionomic model to predict how the GOP Primary elections and caucuses will progress.

Back in late 2009, Nate Silver did a write-up on the possibility of Sarah Palin winning the 2012 GOP Primary. The author correctly recognized that voter demographics present in each state has a significant influence on election results. There is, however, a very large caveat to the possible results of the 2012 GOP Primary -- the social mood of the United States population as a function of time. Social mood has a very strong influence on how people vote, as the vast majority of people vote with their limbic systems (the part of people's brains that induce herding behavior). In bull markets, there is an increasing tendency to vote for centrist candidates, while in bear markets, there is an increasing tendency to vote for radical candidates (especially after the early stages of a bear market of Cycle or larger degree). Factoring in the influence of social mood will give a better picture of how the 2012 GOP Primary is likely to progress.

Sarah Palin isn't in the 2012 GOP race. Of the GOP candidates that have a viable chance of getting the nomination, Mitt Romney is clearly a centrist candidate, Newt Gingrich and Ron Paul are semi-radical candidates, thus making them a decent proxy of Sarah Palin, while Michele Bachmann and Rick Perry are radical candidates, making them an excellent proxy of Sarah Palin.

Currently, we are in the early stages of Primary wave [3] down, just over 7 months so far out of a projected duration of 58 months. Even in 2012, as we go deeper into Primary wave [3] down, social mood may be too bullish for either Michele Bachmann or Rick Perry to with the GOP nomination. A more likely scenario as we go through the heart of Intermediate wave (1) of Primary wave [3] down, is that a semi-radical candidate will have a much better shot at the nomination -- which would favor Newt Gingrich and Ron Paul.

Here is a chart of the DJIA in 2012 with the 2012 GOP Primary elections labelled on the chart:

Here is a step by step walkthrough on how the 2012 GOP Primary could unfold:

Initial wave of states : Iowa, New Hampshire, South Carolina, Florida, and Nevada

Nate Silver rated Iowa and South Carolina as winnable for Sarah Palin, but also indicated that New Hampshire and Nevada would likely go to Mitt Romney.

Iowa is the first state to cast its vote in the 2012 GOP Primary. Iowa holds a caucus rather than a primary. The Iowa caucus takes place as we reach the peak of Minor wave 2 up. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back. Although Iowa tends to turn out conservative voters in its caucus, Mitt Romney could perform surprisingly well with up to 25% of the vote. Look for Newt Gingrich, Ron Paul, and Mitt Romney to put in competitive numbers in the Iowa caucus with all three winning delegates.

New Hampshire is the second state in the GOP Primary. New Hampshire tends to favor centrist candidates, which will give Mitt Romney a substantial advantage. Minor wave 3 down will already be under way when New Hampshire holds its primary. However, Minor wave 3 down is expected to be in its early stages (about half way through Minute wave [i] of Minor wave 3 down) so Mitt Romney will still be able to win the state by a sizable margin even though he will no longer have the wind at his back.

South Carolina would be next after New Hampshire. South Carolina tends to favor conservative candidates. We will be almost a month into Minor wave 3 down with its first subwave almost completed when South Carolina holds its primary. Look for Mitt Romney to put in a weak performance with Newt Gingrich and Ron Paul each picking up 35% to 40% of the vote.

Florida holds its primary at the end of January 2012. Nate Silver rated Florida as below average for Sarah Palin, and its reasonable that it would be below average for Newt Gingrich and Ron Paul as well. We will have completed Minute wave [i] of Minor wave 3 down at this point, so a bearish social mood will almost certainly counter most of the advantage that Mitt Romney would otherwise have. Although Mitt Romney could win the state, look for Newt Gingrich and Ron Paul to put in competitive numbers.

Nevada is the last of the states in the early phase of the 2012 GOP Primary. Nevada plays very strongly to Mitt Romney's advantage. We will be in Minute wave [ii] of Minor wave 3 down. The rising social mood associated with Minute wave [ii] could (at least temporarily) give Mitt Romney a wind at his back. Look for Mitt Romney to win Nevada by a big margin.

Second wave of states -- Montana, Idaho, Wyoming, Alaska, Maine, Nebraska, North Dakota, South Dakota, New Mexico, Hawaii, Delaware, Rhode Island, Vermont, and West Virginia

Nate Silver's analysis back in 2009 indicated that if Sarah Palin can survive the initial wave of states, the second wave of states would be very strong for her. However, the second wave of states also tends to award organizational strength as well, which would be most advantageous to Mitt Romney. The 2012 GOP Primary should be a three man race at this point with Mitt Romney, Newt Gingrich, and Ron Paul vying for the nomination. We will be in the first half of Minute wave [iii] of Minor wave 3 down during this period. Mitt Romney should find success in the early part of this period, but success will get progressively more difficult as we approach the center of Minor wave 3 down. Look for Mitt Romney to win around a third of the states.

Super Tuesday -- Texas Group of states

The later wave of states unfold in three phases with Super Tuesday being the first phase, the second phase unfolding from late March 2012 to early May 2012, and the third phase from mid May 2012 to mid June 2012. The Texas group was rated as good for Sarah Palin's nomination chances (and thus would be an advantage to Newt Gingrich and Ron Paul as well) while the California group and the Pennsylvania group both confer an advantage to Mitt Romney under normal conditions.

By the time Super Tuesday comes around, we will have passed through the center of Minor wave 3 down, triggering an Intermediate degree point of recognition in a bear market. The result will be the "Panic of 2012" with the Obama Administration launching TARP 2 to bail out the banks. In the aftermath of the Intermediate degree point of recognition, the political winds will shift back in the direction of the Republicans, and even within the GOP, the political winds will shift strongly in favor of increasingly radical candidates. This is where Mitt Romney will reach the end of the road as a combination of bearish social mood and the Texas group being advantageous to conservatives will be too much to overcome. Expect Mitt Romney to drop out of the race in the aftermath of a painfully disappointing performance on Super Tuesday.

Pennsylvania Group of states

This phase of the 2012 GOP Primary will unfold during Minute waves [iv] and [v] of Minor wave 3 down. It will be a two man race at this point with Newt Gingrich and Ron Paul battling it out for the nomination. By the end of this period, it should be clear who the Republican nominee will be, depending on how evenly matched the two candidates are against each other

California Group of states

The last phase of the 2012 GOP Primary unfolds during Minor wave 4 up. If the two candidates are evenly matched against each other, we may get a scenario where nobody gets the required number of delegates needed to win the Republican nomination. Endorsements will be key in the last phase of the race if the contest is close.

We are currently in the final part of Minor wave 2 up. Mitt Romney will have the wind at his back for the rest of the year and for the first few days of January 2012. The mainstream media is already convinced that Mitt Romney will win the Republican nomination. By the end of Minor wave 2 up, Mitt Romney will have moved back into first place in all the polls. Once Minor wave 3 down starts unfolding, success will become increasingly difficult for Mitt Romney as the bearish social mood brings out the voter tendency to pick increasingly radical candidates.

Back in late 2009, Nate Silver did a write-up on the possibility of Sarah Palin winning the 2012 GOP Primary. The author correctly recognized that voter demographics present in each state has a significant influence on election results. There is, however, a very large caveat to the possible results of the 2012 GOP Primary -- the social mood of the United States population as a function of time. Social mood has a very strong influence on how people vote, as the vast majority of people vote with their limbic systems (the part of people's brains that induce herding behavior). In bull markets, there is an increasing tendency to vote for centrist candidates, while in bear markets, there is an increasing tendency to vote for radical candidates (especially after the early stages of a bear market of Cycle or larger degree). Factoring in the influence of social mood will give a better picture of how the 2012 GOP Primary is likely to progress.

Sarah Palin isn't in the 2012 GOP race. Of the GOP candidates that have a viable chance of getting the nomination, Mitt Romney is clearly a centrist candidate, Newt Gingrich and Ron Paul are semi-radical candidates, thus making them a decent proxy of Sarah Palin, while Michele Bachmann and Rick Perry are radical candidates, making them an excellent proxy of Sarah Palin.

Currently, we are in the early stages of Primary wave [3] down, just over 7 months so far out of a projected duration of 58 months. Even in 2012, as we go deeper into Primary wave [3] down, social mood may be too bullish for either Michele Bachmann or Rick Perry to with the GOP nomination. A more likely scenario as we go through the heart of Intermediate wave (1) of Primary wave [3] down, is that a semi-radical candidate will have a much better shot at the nomination -- which would favor Newt Gingrich and Ron Paul.

Here is a chart of the DJIA in 2012 with the 2012 GOP Primary elections labelled on the chart:

Here is a step by step walkthrough on how the 2012 GOP Primary could unfold:

Initial wave of states : Iowa, New Hampshire, South Carolina, Florida, and Nevada

Nate Silver rated Iowa and South Carolina as winnable for Sarah Palin, but also indicated that New Hampshire and Nevada would likely go to Mitt Romney.

Iowa is the first state to cast its vote in the 2012 GOP Primary. Iowa holds a caucus rather than a primary. The Iowa caucus takes place as we reach the peak of Minor wave 2 up. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back. Although Iowa tends to turn out conservative voters in its caucus, Mitt Romney could perform surprisingly well with up to 25% of the vote. Look for Newt Gingrich, Ron Paul, and Mitt Romney to put in competitive numbers in the Iowa caucus with all three winning delegates.

New Hampshire is the second state in the GOP Primary. New Hampshire tends to favor centrist candidates, which will give Mitt Romney a substantial advantage. Minor wave 3 down will already be under way when New Hampshire holds its primary. However, Minor wave 3 down is expected to be in its early stages (about half way through Minute wave [i] of Minor wave 3 down) so Mitt Romney will still be able to win the state by a sizable margin even though he will no longer have the wind at his back.

South Carolina would be next after New Hampshire. South Carolina tends to favor conservative candidates. We will be almost a month into Minor wave 3 down with its first subwave almost completed when South Carolina holds its primary. Look for Mitt Romney to put in a weak performance with Newt Gingrich and Ron Paul each picking up 35% to 40% of the vote.

Florida holds its primary at the end of January 2012. Nate Silver rated Florida as below average for Sarah Palin, and its reasonable that it would be below average for Newt Gingrich and Ron Paul as well. We will have completed Minute wave [i] of Minor wave 3 down at this point, so a bearish social mood will almost certainly counter most of the advantage that Mitt Romney would otherwise have. Although Mitt Romney could win the state, look for Newt Gingrich and Ron Paul to put in competitive numbers.

Nevada is the last of the states in the early phase of the 2012 GOP Primary. Nevada plays very strongly to Mitt Romney's advantage. We will be in Minute wave [ii] of Minor wave 3 down. The rising social mood associated with Minute wave [ii] could (at least temporarily) give Mitt Romney a wind at his back. Look for Mitt Romney to win Nevada by a big margin.

Second wave of states -- Montana, Idaho, Wyoming, Alaska, Maine, Nebraska, North Dakota, South Dakota, New Mexico, Hawaii, Delaware, Rhode Island, Vermont, and West Virginia

Nate Silver's analysis back in 2009 indicated that if Sarah Palin can survive the initial wave of states, the second wave of states would be very strong for her. However, the second wave of states also tends to award organizational strength as well, which would be most advantageous to Mitt Romney. The 2012 GOP Primary should be a three man race at this point with Mitt Romney, Newt Gingrich, and Ron Paul vying for the nomination. We will be in the first half of Minute wave [iii] of Minor wave 3 down during this period. Mitt Romney should find success in the early part of this period, but success will get progressively more difficult as we approach the center of Minor wave 3 down. Look for Mitt Romney to win around a third of the states.

Super Tuesday -- Texas Group of states

The later wave of states unfold in three phases with Super Tuesday being the first phase, the second phase unfolding from late March 2012 to early May 2012, and the third phase from mid May 2012 to mid June 2012. The Texas group was rated as good for Sarah Palin's nomination chances (and thus would be an advantage to Newt Gingrich and Ron Paul as well) while the California group and the Pennsylvania group both confer an advantage to Mitt Romney under normal conditions.

By the time Super Tuesday comes around, we will have passed through the center of Minor wave 3 down, triggering an Intermediate degree point of recognition in a bear market. The result will be the "Panic of 2012" with the Obama Administration launching TARP 2 to bail out the banks. In the aftermath of the Intermediate degree point of recognition, the political winds will shift back in the direction of the Republicans, and even within the GOP, the political winds will shift strongly in favor of increasingly radical candidates. This is where Mitt Romney will reach the end of the road as a combination of bearish social mood and the Texas group being advantageous to conservatives will be too much to overcome. Expect Mitt Romney to drop out of the race in the aftermath of a painfully disappointing performance on Super Tuesday.

Pennsylvania Group of states

This phase of the 2012 GOP Primary will unfold during Minute waves [iv] and [v] of Minor wave 3 down. It will be a two man race at this point with Newt Gingrich and Ron Paul battling it out for the nomination. By the end of this period, it should be clear who the Republican nominee will be, depending on how evenly matched the two candidates are against each other

California Group of states

The last phase of the 2012 GOP Primary unfolds during Minor wave 4 up. If the two candidates are evenly matched against each other, we may get a scenario where nobody gets the required number of delegates needed to win the Republican nomination. Endorsements will be key in the last phase of the race if the contest is close.

We are currently in the final part of Minor wave 2 up. Mitt Romney will have the wind at his back for the rest of the year and for the first few days of January 2012. The mainstream media is already convinced that Mitt Romney will win the Republican nomination. By the end of Minor wave 2 up, Mitt Romney will have moved back into first place in all the polls. Once Minor wave 3 down starts unfolding, success will become increasingly difficult for Mitt Romney as the bearish social mood brings out the voter tendency to pick increasingly radical candidates.

Sunday, December 4, 2011

Aura of Exuberant Bullishness

We are definitely in the last part of Minor wave 2 up, and it shows in the form of exuberant bullishness. Virtually everyone is bullish on the stock market, economy, and the job market. Economists, market analysts, and people in the mainstream media are extremely bullish on the economy and the job market.

The massive shift to exuberant bullishness occurred on Wednesday with the intervention of multiple central banks with the aim of shoring up liquidity. The DJIA shot up almost 500 points on that day. The Federal Reserve, the Bank of England, the Bank of Canada, the Bank of Japan, and the European Central Bank all joined in a coordinated move to shore up liquidity in the financial markets. The move also made more dollars available at a cheaper rate. The event resulted in exuberant bullishness with economists and market analysts expressing optimism that the sovereign debt crisis in Europe will be solved once and for all.

The US jobs report came out on Friday. The DJIA, S&P 500, and the Wilshire 500 were virtually flat for the day, rallying in the early hours before giving it all back by the end of the trading session. The job report showed that the "official unemployment rate" (U-3) fell from 9.0% to 8.6% even though job creation remained sluggish. Even before the report came out, economists were already extremely bullish on the job market. Once the job report came out, an aura of exuberant bullishness commenced as even the mainstream media turned extremely bullish on the job market.

The DJIA shot up over 800 points for the week. Virtually everyone is convinced that the stock market will keep rising and are calling for more bull market. Many are even calling for the DJIA and the S&P 500 to exceed their 2007 highs.

There is a pervasive aura of exuberant bullishness in force. This is consistent with the wave personality of a wave 2 in a bear market as analysts, economists, and investors become convinced that the worst is over as calls for more bull market and calls for more economic recovery become louder. We are approaching the end of Minor wave 2 up, with Minor wave 3 down to follow starting in January 2012.

Just like May 2011 when the peak of Primary wave [2] up (2009 - 2011) was reached, President Obama is already declaring victory on the economy and has put up the "Mission Accomplished" sign on the job market.

Aside from the economy, job market, and the stock market, there are two other socionomic indicators that are also signalling that were are in the last part of Minor wave 2 up:

1 -- Occupy Wall Street continues to follow the same pattern as the Tea Party. Recall that the Tea Party was rapidly losing steam with fewer and fewer rallies and protests in the streets as Intermediate wave (C) of Primary wave [2] up unfolded. The same pattern is unfolding with OWS as protests in the streets have rapidly declined since late November 2011 when Minute wave [y] of Minor wave 2 up started. As of today, as I write this, OWS protests have virtually stopped in the United States. The Tea Party was characterized as a "spent force" and a "flash in the pan" by the time we reached the peak of Primary wave [2] up. There is expectation that the mainstream media will characterize OWS as a "flash in the pan" by the time we reach the peak of Minor wave 2 up. We are getting close to that point (perhaps 1 to 4 weeks in the future) but there are already a handful of bloggers making comments about OWS getting exhausted, such as this one that appeared on CNBC.

2 -- Virtually everyone in the mainstream media is strongly convinced that Mitt Romney will be the Republican nominee. This trend was easily predictable using the socionomic model as voters have a tendency to vote for centrist candidates as social mood becomes increasingly bullish and radical candidates as social mood becomes increasingly bearish. Intrade was giving Mitt Romney as much as a 70% chance of winning the Republican Primary. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back in the Republican Primary. Once Minor wave 3 down starts in January 2012, Mitt Romney will face increasingly stiff headwinds as the voter tendency to vote for radical candidates increases over time.

We will be facing increasingly hard times in 2012 as we go deeper into Primary wave [3] down. For now, there is an aura of exuberant bullishness that is expected to persist through the holidays. The job market is having its last gasp as the creation of jobs reflects hiring in anticipation of Black Friday and the holiday shopping season.

The massive shift to exuberant bullishness occurred on Wednesday with the intervention of multiple central banks with the aim of shoring up liquidity. The DJIA shot up almost 500 points on that day. The Federal Reserve, the Bank of England, the Bank of Canada, the Bank of Japan, and the European Central Bank all joined in a coordinated move to shore up liquidity in the financial markets. The move also made more dollars available at a cheaper rate. The event resulted in exuberant bullishness with economists and market analysts expressing optimism that the sovereign debt crisis in Europe will be solved once and for all.

The US jobs report came out on Friday. The DJIA, S&P 500, and the Wilshire 500 were virtually flat for the day, rallying in the early hours before giving it all back by the end of the trading session. The job report showed that the "official unemployment rate" (U-3) fell from 9.0% to 8.6% even though job creation remained sluggish. Even before the report came out, economists were already extremely bullish on the job market. Once the job report came out, an aura of exuberant bullishness commenced as even the mainstream media turned extremely bullish on the job market.

The DJIA shot up over 800 points for the week. Virtually everyone is convinced that the stock market will keep rising and are calling for more bull market. Many are even calling for the DJIA and the S&P 500 to exceed their 2007 highs.

There is a pervasive aura of exuberant bullishness in force. This is consistent with the wave personality of a wave 2 in a bear market as analysts, economists, and investors become convinced that the worst is over as calls for more bull market and calls for more economic recovery become louder. We are approaching the end of Minor wave 2 up, with Minor wave 3 down to follow starting in January 2012.

Just like May 2011 when the peak of Primary wave [2] up (2009 - 2011) was reached, President Obama is already declaring victory on the economy and has put up the "Mission Accomplished" sign on the job market.

Aside from the economy, job market, and the stock market, there are two other socionomic indicators that are also signalling that were are in the last part of Minor wave 2 up:

1 -- Occupy Wall Street continues to follow the same pattern as the Tea Party. Recall that the Tea Party was rapidly losing steam with fewer and fewer rallies and protests in the streets as Intermediate wave (C) of Primary wave [2] up unfolded. The same pattern is unfolding with OWS as protests in the streets have rapidly declined since late November 2011 when Minute wave [y] of Minor wave 2 up started. As of today, as I write this, OWS protests have virtually stopped in the United States. The Tea Party was characterized as a "spent force" and a "flash in the pan" by the time we reached the peak of Primary wave [2] up. There is expectation that the mainstream media will characterize OWS as a "flash in the pan" by the time we reach the peak of Minor wave 2 up. We are getting close to that point (perhaps 1 to 4 weeks in the future) but there are already a handful of bloggers making comments about OWS getting exhausted, such as this one that appeared on CNBC.

2 -- Virtually everyone in the mainstream media is strongly convinced that Mitt Romney will be the Republican nominee. This trend was easily predictable using the socionomic model as voters have a tendency to vote for centrist candidates as social mood becomes increasingly bullish and radical candidates as social mood becomes increasingly bearish. Intrade was giving Mitt Romney as much as a 70% chance of winning the Republican Primary. While Minor wave 2 up is unfolding, Mitt Romney will have the wind at his back in the Republican Primary. Once Minor wave 3 down starts in January 2012, Mitt Romney will face increasingly stiff headwinds as the voter tendency to vote for radical candidates increases over time.

We will be facing increasingly hard times in 2012 as we go deeper into Primary wave [3] down. For now, there is an aura of exuberant bullishness that is expected to persist through the holidays. The job market is having its last gasp as the creation of jobs reflects hiring in anticipation of Black Friday and the holiday shopping season.

Tuesday, November 29, 2011

Santa Claus Rally in Sight

A Santa-Claus rally, which is the third and final phase of the three month long reprieve period known as Minor wave 2 up, is on the short-term horizon. This is an update to an earlier blog entry in which a case was made for the rally in October 2011 being just the first part of Minor wave 2 up on the basis that it is all the same market in a deflationary scenario as proposed by Elliott Wave International several years ago.

Here are the updated charts of the DAX and the CAC-40.

DAX:

CAC-40:

Both the DAX and the CAC-40 rallied from the late September 2011 low in five waves, which indicated that the late October 2011 high represented the end of just the first part of Minor wave 2 up. The rally was followed by a decline that unfolded through most of November 2011. In both the DAX and the CAC-40, the decline unfolded in three waves and ended above the late September 2011 low. The sharp rally that started on Monday is the start of the last part of Minor wave 2 up in France and Germany, namely Minute wave [c] of Minor wave 2 up.

Here are the updated charts of the FTSE-100 and the DJIA:

FTSE-100:

DJIA:

Both the DJIA and the FTSE-100 rallied from the early October 2011 low in three waves. Both the DJIA and the FTSE-100 are still in the second part of Minor wave 2 up, namely Minute wave [x] of Minor wave 2 up. The decline from the late October 2011 high unfolded in three waves through most of November 2011.

The preferred scenario is that Minute wave [x] of Minor wave 2 up is a double zigzag with the second zigzag taking the markets far enough down to fill the gap at 1151 - 1155 in the S&P 500. Within Minute wave [x], the first zigzag, Minuette wave (w) was completed last Friday. There was a strong expectation for Minuette wave (x) to unfold as a sharp rally. The expectations were dramatically fulfilled with the DJIA doing a 250 point gap up on Monday morning. Minuette wave (x) should be completed tomorrow (perhaps a 150 - 200 point gain in the DJIA for the day). The sharp rally will be followed by a second zigzag, Minuette wave (y), which is expected to unfold as a sharp decline, completing Minute wave [x] around December 6, 2011 with a downside target of 11050 in the DJIA and 1125 in the S&P 500.

The Santa-Claus rally is expected to start on December 6, 2011 on the DJIA and the FTSE-100, representing the last part of the three month long reprieve period. The rally is expected to unfold in three waves and take the DJIA just above 12000 in early January 2012.

A bullish intra-market divergence is forming, where the DJIA falls below the late November 2011 low in early December 2011, but the low isn't confirmed in the FTSE-100, the DAX, or the CAC-40. The end of Minor wave 2 up may be characterized by a bearish intra-market divergence in which the CAC-40 and the DAX rally above their late October 2011 highs, but the DJIA and the FTSE-100 fail to do so.

Here are the updated charts of the DAX and the CAC-40.

DAX:

CAC-40:

Both the DAX and the CAC-40 rallied from the late September 2011 low in five waves, which indicated that the late October 2011 high represented the end of just the first part of Minor wave 2 up. The rally was followed by a decline that unfolded through most of November 2011. In both the DAX and the CAC-40, the decline unfolded in three waves and ended above the late September 2011 low. The sharp rally that started on Monday is the start of the last part of Minor wave 2 up in France and Germany, namely Minute wave [c] of Minor wave 2 up.

Here are the updated charts of the FTSE-100 and the DJIA:

FTSE-100:

DJIA:

Both the DJIA and the FTSE-100 rallied from the early October 2011 low in three waves. Both the DJIA and the FTSE-100 are still in the second part of Minor wave 2 up, namely Minute wave [x] of Minor wave 2 up. The decline from the late October 2011 high unfolded in three waves through most of November 2011.

The preferred scenario is that Minute wave [x] of Minor wave 2 up is a double zigzag with the second zigzag taking the markets far enough down to fill the gap at 1151 - 1155 in the S&P 500. Within Minute wave [x], the first zigzag, Minuette wave (w) was completed last Friday. There was a strong expectation for Minuette wave (x) to unfold as a sharp rally. The expectations were dramatically fulfilled with the DJIA doing a 250 point gap up on Monday morning. Minuette wave (x) should be completed tomorrow (perhaps a 150 - 200 point gain in the DJIA for the day). The sharp rally will be followed by a second zigzag, Minuette wave (y), which is expected to unfold as a sharp decline, completing Minute wave [x] around December 6, 2011 with a downside target of 11050 in the DJIA and 1125 in the S&P 500.

The Santa-Claus rally is expected to start on December 6, 2011 on the DJIA and the FTSE-100, representing the last part of the three month long reprieve period. The rally is expected to unfold in three waves and take the DJIA just above 12000 in early January 2012.

A bullish intra-market divergence is forming, where the DJIA falls below the late November 2011 low in early December 2011, but the low isn't confirmed in the FTSE-100, the DAX, or the CAC-40. The end of Minor wave 2 up may be characterized by a bearish intra-market divergence in which the CAC-40 and the DAX rally above their late October 2011 highs, but the DJIA and the FTSE-100 fail to do so.

Friday, November 25, 2011

Visions of 2068

There have already been visions of what the United States might look like in the future if the "Occupy Wall Street" protests successfully bring about a "peaceful revolution" in the nation. Many people who see such a scenario envision change being achieved within the next several years. The socionomic model, however, hints that such change is decades, not just years, in the future.

Governments generally stay their course all the way to the bottom. The bottom, in this case of the current bear market, is the orthodox low point of Grand Supercycle wave [IV], which is projected to end in 2055. Only when the bottom is reached will governments start making the hard choices. Here are three examples:

1 -- The original Bill of Rights were introduced in Congress in 1789 and went into effect as amendments in 1791. The Constitution of the United States was adopted in 1787. The Bill of Rights were instituted shortly after the start of Grand Supercycle wave [III] in 1784. This event followed the end of the "Modern European Major Depression" that spanned from 1720 to 1784.

2 -- Reconstruction was instituted in 1865 and continued until 1877. This period represents a fundamental transformation of society in the United States in the aftermath of the Civil War. The Reconstruction was instituted shortly after the start of Supercycle wave (III) and followed the end of the "Long Depression" that spanned from 1835 - 1859.

3 -- The New Deal consisted of a series of economic programs aimed at getting the US economy back in gear. The New Deal started in 1933 and continued through 1936. The New Deal was launched shortly after the start of Supercycle wave (V) and followed the end of the Great Depression that spanned from 1929 - 1932. The best known parts of the New Deal are the Glass-Steagall Act (regulations on banking, was repealed in 1999), the Fair Labor Standard Act (sets a federal minimum wage and caps the work week at 40 hours a week, expected to be repealed in 2017), and the Social Security Act (this implemented Social Security for the elderly, expected to be repealed in 2017).

The visions and goals of "Occupy Wall Street" are a hint of what the United States might look like in the future. One of the leading activists of the "Occupy Wall Street" movement is Michael Moore, who recently put an article on Daily Kos, spelling out some of the goals of the movement. One of the goals is the implementation of a Second Bill of Rights that was first proposed by FDR in 1944, which would serve as an "economic bill of rights" that guaranteed the following:

1 -- Employment with a living wage

2 -- Housing

3 -- Medical Care

4 -- Education

5 -- Social Security

6 -- Freedom from unfair competition and monopolies

Once the current bear market is over, a new bull market, Grand Supercycle wave [V], will start. Governments won't start making the hard choices until the "Crisis of the Western World" has ended. The vision of reform in the United States by FDR in 1944 and Michael Moore from 2007 to present will eventually come to pass. Implementation of such reforms is expected to start in 2060 and could be completed in 2068.

Governments generally stay their course all the way to the bottom. The bottom, in this case of the current bear market, is the orthodox low point of Grand Supercycle wave [IV], which is projected to end in 2055. Only when the bottom is reached will governments start making the hard choices. Here are three examples:

1 -- The original Bill of Rights were introduced in Congress in 1789 and went into effect as amendments in 1791. The Constitution of the United States was adopted in 1787. The Bill of Rights were instituted shortly after the start of Grand Supercycle wave [III] in 1784. This event followed the end of the "Modern European Major Depression" that spanned from 1720 to 1784.

2 -- Reconstruction was instituted in 1865 and continued until 1877. This period represents a fundamental transformation of society in the United States in the aftermath of the Civil War. The Reconstruction was instituted shortly after the start of Supercycle wave (III) and followed the end of the "Long Depression" that spanned from 1835 - 1859.

3 -- The New Deal consisted of a series of economic programs aimed at getting the US economy back in gear. The New Deal started in 1933 and continued through 1936. The New Deal was launched shortly after the start of Supercycle wave (V) and followed the end of the Great Depression that spanned from 1929 - 1932. The best known parts of the New Deal are the Glass-Steagall Act (regulations on banking, was repealed in 1999), the Fair Labor Standard Act (sets a federal minimum wage and caps the work week at 40 hours a week, expected to be repealed in 2017), and the Social Security Act (this implemented Social Security for the elderly, expected to be repealed in 2017).

The visions and goals of "Occupy Wall Street" are a hint of what the United States might look like in the future. One of the leading activists of the "Occupy Wall Street" movement is Michael Moore, who recently put an article on Daily Kos, spelling out some of the goals of the movement. One of the goals is the implementation of a Second Bill of Rights that was first proposed by FDR in 1944, which would serve as an "economic bill of rights" that guaranteed the following:

1 -- Employment with a living wage

2 -- Housing

3 -- Medical Care

4 -- Education

5 -- Social Security

6 -- Freedom from unfair competition and monopolies

Once the current bear market is over, a new bull market, Grand Supercycle wave [V], will start. Governments won't start making the hard choices until the "Crisis of the Western World" has ended. The vision of reform in the United States by FDR in 1944 and Michael Moore from 2007 to present will eventually come to pass. Implementation of such reforms is expected to start in 2060 and could be completed in 2068.

Monday, November 21, 2011

Social Mood Undercurrents

Even as the three month long reprieve period continues to run its course, we continue to see more and more undercurrents of bearish social mood underneath the surface, ready to erupt to the surface with the advent of Minor wave 3 down in January 2012.

The European debt crisis is still a concern even as it remains in remission (just barely, it is so fragile that it could give out at any time), yet there is evidence that the contagion is starting to spread all the way to the core of the European Union. There have been a number of developments in the last several days:

1 -- Interest rates on Spanish, Italian, Greek, Portuguese, and even French bonds continue to rise, making it more expensive to borrow. The effect, of course, is to make the existing debt a heavier burden to bear as the interest payments on the debt continue to rise. As taxpayer money continues to dry up in the coming months and years, a default is just a matter of time. The most likely scenario is for one or more of the PIIGS to default on their debt as we approach the center of Minor wave 3 down in March / April 2012. Greece is already perilously close to default.

2 -- The sovereign debt crisis has already taken a toll on governments in the European Union. The latest development is a massive wave of voter anger effectively removing the Socialist party from power in Spain and bringing conservatives into power by a substantial margin. This unfolded quickly on the heels of a government upheaval in Italy and Greece in which technocrats gained power. In addition, Greece is now facing the same type of strife and discord as the United States as partisan gridlock has put the country on the verge of a virtual government shutdown.

3 -- France is now facing the threat of a credit rating downgrade as Moody's has downgraded the outlook on the country's credit rating due to rising interest rates. This development is a very strong indication that the debt contagion is spreading to the core of the European Union. France is one of the last of the larger nations on the planet to still have a AAA credit rating.

4 -- The 2008 parallel continues to play out in the United States. On the heels of the collapse of MF Global and the bankruptcy of Jefferson County, Alabama, the city of Detroit, Michigan is on the verge of running out of cash, with bankruptcy to likely follow during the center of Minor wave 3 down. Another recent development is the US Postal Service bleeding cash at a rapid clip with default in the near future. The US Postal Service will almost certainly be in need of a bailout during the center of Minor wave 3 down.

We are about halfway through Minor wave 2 up with the "Santa-Claus rally" poised to start in early December 2011. Even as the reprieve period continues to run its course, undercurrents of bearish social mood simmer underneath the surface with financial fault lines in both Europe and the United States ready to go critical.

The European debt crisis is still a concern even as it remains in remission (just barely, it is so fragile that it could give out at any time), yet there is evidence that the contagion is starting to spread all the way to the core of the European Union. There have been a number of developments in the last several days:

1 -- Interest rates on Spanish, Italian, Greek, Portuguese, and even French bonds continue to rise, making it more expensive to borrow. The effect, of course, is to make the existing debt a heavier burden to bear as the interest payments on the debt continue to rise. As taxpayer money continues to dry up in the coming months and years, a default is just a matter of time. The most likely scenario is for one or more of the PIIGS to default on their debt as we approach the center of Minor wave 3 down in March / April 2012. Greece is already perilously close to default.

2 -- The sovereign debt crisis has already taken a toll on governments in the European Union. The latest development is a massive wave of voter anger effectively removing the Socialist party from power in Spain and bringing conservatives into power by a substantial margin. This unfolded quickly on the heels of a government upheaval in Italy and Greece in which technocrats gained power. In addition, Greece is now facing the same type of strife and discord as the United States as partisan gridlock has put the country on the verge of a virtual government shutdown.

3 -- France is now facing the threat of a credit rating downgrade as Moody's has downgraded the outlook on the country's credit rating due to rising interest rates. This development is a very strong indication that the debt contagion is spreading to the core of the European Union. France is one of the last of the larger nations on the planet to still have a AAA credit rating.

4 -- The 2008 parallel continues to play out in the United States. On the heels of the collapse of MF Global and the bankruptcy of Jefferson County, Alabama, the city of Detroit, Michigan is on the verge of running out of cash, with bankruptcy to likely follow during the center of Minor wave 3 down. Another recent development is the US Postal Service bleeding cash at a rapid clip with default in the near future. The US Postal Service will almost certainly be in need of a bailout during the center of Minor wave 3 down.

We are about halfway through Minor wave 2 up with the "Santa-Claus rally" poised to start in early December 2011. Even as the reprieve period continues to run its course, undercurrents of bearish social mood simmer underneath the surface with financial fault lines in both Europe and the United States ready to go critical.

Thursday, November 17, 2011

Pitfalls in November

We are about half way through the three month long reprieve period known as Minor wave 2 up. Reprieve periods do not mean that we will get "rainbows and unicorns", it means a period where conditions temporarily improve but the larger bearish trend in social mood is expected to return with a vengeance after the bear market rally ends. Reprieve periods can still be riddled full of pitfalls. We saw an example of that case in April 2010 to June 2010, during Intermediate wave (B) of Primary wave [2] up (Mar 2009 - May 2011) when the European debt crisis started to rear its ugly head for the first time.

The current reprieve period has definitely been riddled full of pitfalls with most of them occurring after the second part of Minor wave 2 up (Minute wave [x] for the DJIA, S&P 500, and the FTSE 100, Minute wave [b] for the DAX and the CAC-40) started. Here is a list of some of the pitfalls that have occurred:

1 -- Interest rates on Italian, Spanish, and even French bonds have been on the rise, intensifying the pain of the European debt crisis. The debt crisis is still in remission, but is expected to return with a vengeance in January 2012 (if not sooner).

2 -- Mass police crackdowns against the "Occupy Wall Street" protests unfolded a few days ago with the involvement of the Department of Homeland Security. The crackdowns were mostly a show of intimidation as legions of police officers in full riot gear were deployed in a number of major cities to clear out the protests.

3 -- A version of the "Internet Blacklist Bill" with the name "SOPA" is moving through Congress and it has bipartisan support. This is a blatant form of authoritarianism as the law can be used to shut down large blocks of the Internet under the pretense of fighting piracy, which would result in the Internet becoming increasingly fragmented over time. As I discussed in an earlier blog entry, the bill is mostly supported by the top 1% and it may be an indication that governments are making their move to break the back of the "Occupy Wall Street" protests as the law can result in shutting down Facebook, Twitter, and You Tube (all three have been utilized by the OWS movement).

We are in the second phase of the reprieve period. Here is a chart of the DJIA showing the projected wave path of Minute wave [x] of Minor wave 2 up. Minor wave 2 up appears to be tracing a double zigzag.

The preferred scenario for Minute wave [x] is a double zigzag with the first zigzag, Minuette wave (w), just about done and the second zigzag to take the markets far enough down to fill the gap at 1151 in the S&P 500 (which would be the equivalent to 11100 in the DJIA).

A sharp rally, which would be Minuette wave (x) of Minute wave [x], should unfold next week, pushing the DJIA up roughly 500 points to around 12000. This should be followed by a sharp decline in three waves as a second zigzag, Minuette wave (y) of Minute wave [x], takes the DJIA down to around 10950 and the S&P 500 down to roughly 1125 by early December 2011.

A Santa-Claus rally, which would be Minute wave [y], should unfold through December 2011 and into early January 2012, completing Minor wave 2 up with a target of 11950 in the DJIA and 1260 in the S&P 500. The downward momentum associated with Primary wave [3] down is expected to re-assert itself in late December 2011, creating the appearance of a running flat in which Minute wave [y] falls short of the peak of Minute wave [w].

The current reprieve period has definitely been riddled full of pitfalls with most of them occurring after the second part of Minor wave 2 up (Minute wave [x] for the DJIA, S&P 500, and the FTSE 100, Minute wave [b] for the DAX and the CAC-40) started. Here is a list of some of the pitfalls that have occurred:

1 -- Interest rates on Italian, Spanish, and even French bonds have been on the rise, intensifying the pain of the European debt crisis. The debt crisis is still in remission, but is expected to return with a vengeance in January 2012 (if not sooner).

2 -- Mass police crackdowns against the "Occupy Wall Street" protests unfolded a few days ago with the involvement of the Department of Homeland Security. The crackdowns were mostly a show of intimidation as legions of police officers in full riot gear were deployed in a number of major cities to clear out the protests.

3 -- A version of the "Internet Blacklist Bill" with the name "SOPA" is moving through Congress and it has bipartisan support. This is a blatant form of authoritarianism as the law can be used to shut down large blocks of the Internet under the pretense of fighting piracy, which would result in the Internet becoming increasingly fragmented over time. As I discussed in an earlier blog entry, the bill is mostly supported by the top 1% and it may be an indication that governments are making their move to break the back of the "Occupy Wall Street" protests as the law can result in shutting down Facebook, Twitter, and You Tube (all three have been utilized by the OWS movement).

We are in the second phase of the reprieve period. Here is a chart of the DJIA showing the projected wave path of Minute wave [x] of Minor wave 2 up. Minor wave 2 up appears to be tracing a double zigzag.

The preferred scenario for Minute wave [x] is a double zigzag with the first zigzag, Minuette wave (w), just about done and the second zigzag to take the markets far enough down to fill the gap at 1151 in the S&P 500 (which would be the equivalent to 11100 in the DJIA).

A sharp rally, which would be Minuette wave (x) of Minute wave [x], should unfold next week, pushing the DJIA up roughly 500 points to around 12000. This should be followed by a sharp decline in three waves as a second zigzag, Minuette wave (y) of Minute wave [x], takes the DJIA down to around 10950 and the S&P 500 down to roughly 1125 by early December 2011.

A Santa-Claus rally, which would be Minute wave [y], should unfold through December 2011 and into early January 2012, completing Minor wave 2 up with a target of 11950 in the DJIA and 1260 in the S&P 500. The downward momentum associated with Primary wave [3] down is expected to re-assert itself in late December 2011, creating the appearance of a running flat in which Minute wave [y] falls short of the peak of Minute wave [w].

Wednesday, November 16, 2011

Limits and Conservation

Politicians continue to focus more on limits as the larger bear market continues to unfold. Back in July 2011, the GOP advanced the Cut, Cap, and Balance bill during the debt ceiling crisis, which was approved along party lines in the House, but was scuttled in the Senate. The formation of a "Super Congress" was a result of a debt ceiling deal, which has been tasked with cutting the deficit by over a trillion dollars over a decade.

Just four months later, the "Super Congress" has been unable to reach a deal on a deficit deal as strife and discord continue to cause division in the committee. In spite of the increase in strife and discord, the austerity trend is spreading beyond the red states. Even some blue states are participating in the austerity trend. A case of point is Gov. Chris Gregoire (of the state of Washington) pushing for $2.3 billion in budget cuts that will have a substantial impact on the state's subsidized health care, increase class sizes in schools, and cut the length of supervision for inmates released from prison.

The latest example of limits and conservation is the Balanced Budget Amendment, which is not only endorsed by the GOP and the Tea Party, but also has support of "Blue Dog" democrats as well. The austerity trend has spread beyond the GOP and the Tea Party and even the Democratic Party is beginning to take part in the austerity trend. Economists are already recognizing the implications of such an amendment, stating that the amendment would result in the loss of 15 million jobs, and that is before considering the effect of businesses and corporations imploding due to a cascade of debt defaults. This scenario fits with the forecast of the destruction of 36 million jobs during the course of Primary wave [3] down (2011 - 2016), pushing the unemployment rate (U6) up to 40% by 2016.

The austerity trend, which is now becoming more and more bi-partisan over time, is indicative of a bear market in progress, as people tend to focus on limits and conservation during bear markets. The latest attempt at a balanced budget amendment is expected to be scuttled (most likely in the Senate) as there is not enough bearish social mood for the amendment to pass. The most likely time frame for a balanced budget amendment to pass is 2017 after a massive wave of voter anger (larger than 1932) throws most of the liberal progressive politicians out of office in all levels of government in the 2016 election.

On the shorter term, one of the possible events in the political arena that could signal the peak of Minor wave 2 up is the "Super Congress" successfully reaching a deal in cutting the deficit. Such an event could generate a short-lived euphoria, much like the Greek deal in late October 2011 that resulted in banks taking a 50% haircut on Greek debt. Such a euphoria would be short lived as the bearish social mood associated with Minor wave 3 down would take over in very short order.

Just four months later, the "Super Congress" has been unable to reach a deal on a deficit deal as strife and discord continue to cause division in the committee. In spite of the increase in strife and discord, the austerity trend is spreading beyond the red states. Even some blue states are participating in the austerity trend. A case of point is Gov. Chris Gregoire (of the state of Washington) pushing for $2.3 billion in budget cuts that will have a substantial impact on the state's subsidized health care, increase class sizes in schools, and cut the length of supervision for inmates released from prison.

The latest example of limits and conservation is the Balanced Budget Amendment, which is not only endorsed by the GOP and the Tea Party, but also has support of "Blue Dog" democrats as well. The austerity trend has spread beyond the GOP and the Tea Party and even the Democratic Party is beginning to take part in the austerity trend. Economists are already recognizing the implications of such an amendment, stating that the amendment would result in the loss of 15 million jobs, and that is before considering the effect of businesses and corporations imploding due to a cascade of debt defaults. This scenario fits with the forecast of the destruction of 36 million jobs during the course of Primary wave [3] down (2011 - 2016), pushing the unemployment rate (U6) up to 40% by 2016.