In the last few weeks, Apple has seen its stock price (and its valuation) soar into the stratosphere, reaching $500 a share before pulling back. The company's stock has started to go parabolic even on a logarithmic chart, indicating that the stock is in the late stages of a bubble after decades of advances. Along with its stock price, the company achieved a revenue of $108 billion and a profit of $26 billion in 2011.

Here is a long term chart of Apple, which is a component of the S&P 500, Nasdaq, and the Nasdaq-100:

The company's stock was on the tail end of Cycle wave III up when it went public. After reaching a Cycle degree peak in 1991, the company's stock declined for over 6 years, completing Cycle wave IV in 1997 with a low of just over $3 a share. From the low in 1997, the company's stock price and valuation has soared into the stratosphere, recently hitting $500 a share as Cycle wave V comes closer to completion.

Here is a close-up of Primary wave [5] of Cycle wave V up:

Apple's stock price could conceivably hit $1000 a share at the height of the mania before the bubble bursts. The stock is going parabolic now -- as the mania reaches its epic peak, the stock price should spike higher into the stratosphere. The last phase of the mania should commence with the start of Intermediate wave (5) up around April 2012. After hitting the peak, which could be $1000 a share or more, the bubble should burst in June 2012 as the business cycle high point is reached. Since Apple makes up a substantial part of both the S&P 500 and the Nasdaq, the spike in the company's stock price should play a strong role in pushing the S&P 500 up to 1440 and the Nasdaq up to 3100 by June 2012.

There is additional evidence that the large degree peak is close at hand. First is the magazine cover indicator, in which the company was featured in 2 magazine covers. A third appearance on a magazine cover is still possible, especially after the company's stock price hits $750 a share. The magazine cover indicator is a well known contrarian indicator that can signal that a reversal is imminent as almost everyone will have acted on the trend by then. Second is the strong level of speculation in the company's stock as a record 216 hedge funds have Apple stock in their portfolios. The strong level of speculation means that there is a strong level of bullishness present. Optimism is sky high as Reuters is speculating that Apple could be the first company to achieve a valuation of $1 trillion. Some mainstream media journalists are going even further with the linear extrapolation, calling for Apple's valuation to go as high as $3 trillion by 2022.

In many ways, the parabolic spike in Apple is comparable to the South Sea Bubble in 1720. In early 1720, the company's stock price was around 165 pounds a share when news of the company bearing England's debt burden sets off a speculative frenzy that causes the stock to soar as high as 1000 pounds a share. In September 1720, the bubble burst, ushering in a 64 year bear market and major depression in the economy. Apple is indeed following the same pattern as the South Sea Company with a speculative frenzy now in the early stages with an epic super-spike still in the future. Even now, there is a great deal of speculation and anticipation about the iPad 3. There are already rumors that the iPad 3 could be comparable to a PC in terms of capabilities and that it will soon be released into the marketplace. A hand-held device with capabilities comparable to a PC would indeed be a game-changer in the economy in the same way that the South Sea Company bearing England's debt burden was back in 1720, and could indeed be the catalyst that triggers the epic super spike in the company's stock.

The South Sea Bubble ended in a bust, and there is every reason to believe that the "Apple Bubble" will also end in a bust. The bursting of the Apple bubble will usher in the next part of the long bear market. With many hedge fund managers and investors owing Apple stock, the implications of the bust will be widespread with a lot of wealth disappearing into thin air in a matter of months as the DJIA falls from 13750 in June 2012 to around 5500 by 2016.

Sunday, February 26, 2012

Monday, February 20, 2012

Update on the 2017 Oil Supply Crash

This blog entry is an update on an earlier entry on the issue of Peak Oil and the oil supply crash that is coming in 2017. We are still on track for the oil supply crash to unfold in 2017. While virtually all "Peak Oilers" believe that the price of crude oil will go into an inflationary spiral after peak production is reached, in which Peak Oil is brought about through the process of exhausting a finite non-renewable resource, there is a case to be made that the oil supply crash will actually be caused by a combination of a deflationary spiral in the commodities market and corporate greed.

Big Oil, like any other industry, must be able to make a profit in order to stay viable in the larger global economy. In fact, the number one modus operandi of corporations, above all else, is to make a profit. When push comes to shove, corporations will always choose a smaller profit over taking a hit on their balance sheet. This is important because the cost of producing a barrel of oil varies by source. It costs only $5 to produce a barrel of oil from underground such as the oil fields found in Saudi Arabia, but it costs $25 to produce a barrel of oil from deep sea drilling and $70 to produce a barrel of oil from tar sands and shale. Most of the cheap, easy to get crude oil has already been depleted and geologists are already scouring the ends of the earth to try to find more oil. Most of the oil that is produced today comes from deep sea drilling, tar sands, and shale.

Extracting crude oil from shale and tar sands is economically viable now because crude oil in the commodities market has stayed at elevated levels for quite a long time, currently at $105 a barrel and rising. Once the deflationary spiral resumes later this year, crude oil futures will reach a sufficiently low level that it will no longer be economically viable for Big Oil (and OPEC for that matter) to produce crude oil from tar sands, deep sea drilling, and shale. The result will be an oil supply crash in 2017 as Big Oil shuts down production of oil from tar sands, deep sea drilling, and shale, to protect their profits. This type of scenario has been unfolding with natural gas for 4 years as drillers cut drilling and production in response to falling natural gas futures. If it can happen with natural gas, it can also happen with crude oil as well.

Before the deflationary spiral resumes later this year, crude oil will keep rising as it is quite evident that it is tracing out a regular flat or an expanded flat. The peak for the year should be reached when the high point of the current business cycle is reached, which would be June 2012. Here is a chart of Crude Oil from the 2008 peak:

Here is a chart showing a close-up of the last 2 years:

The minimum upside target is $135.50 a barrel for a regular flat (90% retracement of Primary wave [A]) and the guideline target (for an expanded flat) is $170 a barrel. The reason for the flat or expanded flat scenario is because it is quite evident that Primary wave [B] up is tracing out a complex structure (most likely a double zigzag). A simple 3 wave structure for wave A, followed by a complex structure for wave B, fits the guideline for a flat or expanded flat quite well.

Gas prices at the pump will follow crude oil higher into the business cycle high point. The trend is already being recognized by the mainstream media, as gas prices have jumped to $3.53 a gallon (US average) with prices already as high as $4.25 a gallon on the West Coast. Although the mainstream media is expecting gas prices at the pump to hit $4.25 a gallon (US average) later this year, one must account for the scenario of crude oil reaching the $135.50 - $170 a barrel target. Factoring the higher crude oil prices that will unfold in the near future, there is a high probability that gas prices at the pump will hit $5 a gallon in much of the United States, with gas prices going as high as $6 a gallon on the west coast of California. Rising gas prices should act to bring about a fast and abrupt reversal in the job creation trend as businesses will likely take a big hit from rising transportation costs.

After the high is put in for the year, Primary wave [C] down will follow, resulting in a resumption of a deflationary spiral in crude oil prices, eventually creating an economic environment where production of oil from tar sands, shale, and deep sea drilling is no longer economically viable.

Since everything moves together in a deflationary environment ("All the same market"), crude oil futures will remain at depressed levels after the flat or expanded flat structure is completed, which is expected to be Cycle wave w of Supercycle wave (a). Here is a long-term chart of crude oil illustrating the outlook of crude oil during "The Great Deflation":

Cycle wave w is expected to be completed at the next business cycle low point in 2016 with a downside target of around $8 a barrel. With crude oil futures at depressed levels for a number of years, Big Oil will inevitably shut down production of oil from tar sands, deep sea drilling, and shale, in order to protect their profits. The result of a mass shutdown in oil production will result in a 75% reduction in oil supply, causing an oil supply crash in 2017.

The oil supply crash is one of the defining characteristics of the coming Bachmann Administration Period (2017 - 2024). The result of an oil supply crash is that economic and living conditions on "Main Street" will return to the level of the 1930s. The oil supply crash will also play a substantial role in the implosion of 90% of corporations and businesses on the planet since goods can no longer get transported long distances. The economy will become increasingly local. Mom and pop businesses will return to the forefront as corporations shatter like glass. Family farms and farmers markets will make a strong comeback as corporate farms shut down from being unable to transport their finished goods long distances due to an oil supply shortage.

Big Oil, like any other industry, must be able to make a profit in order to stay viable in the larger global economy. In fact, the number one modus operandi of corporations, above all else, is to make a profit. When push comes to shove, corporations will always choose a smaller profit over taking a hit on their balance sheet. This is important because the cost of producing a barrel of oil varies by source. It costs only $5 to produce a barrel of oil from underground such as the oil fields found in Saudi Arabia, but it costs $25 to produce a barrel of oil from deep sea drilling and $70 to produce a barrel of oil from tar sands and shale. Most of the cheap, easy to get crude oil has already been depleted and geologists are already scouring the ends of the earth to try to find more oil. Most of the oil that is produced today comes from deep sea drilling, tar sands, and shale.

Extracting crude oil from shale and tar sands is economically viable now because crude oil in the commodities market has stayed at elevated levels for quite a long time, currently at $105 a barrel and rising. Once the deflationary spiral resumes later this year, crude oil futures will reach a sufficiently low level that it will no longer be economically viable for Big Oil (and OPEC for that matter) to produce crude oil from tar sands, deep sea drilling, and shale. The result will be an oil supply crash in 2017 as Big Oil shuts down production of oil from tar sands, deep sea drilling, and shale, to protect their profits. This type of scenario has been unfolding with natural gas for 4 years as drillers cut drilling and production in response to falling natural gas futures. If it can happen with natural gas, it can also happen with crude oil as well.

Before the deflationary spiral resumes later this year, crude oil will keep rising as it is quite evident that it is tracing out a regular flat or an expanded flat. The peak for the year should be reached when the high point of the current business cycle is reached, which would be June 2012. Here is a chart of Crude Oil from the 2008 peak:

Here is a chart showing a close-up of the last 2 years:

The minimum upside target is $135.50 a barrel for a regular flat (90% retracement of Primary wave [A]) and the guideline target (for an expanded flat) is $170 a barrel. The reason for the flat or expanded flat scenario is because it is quite evident that Primary wave [B] up is tracing out a complex structure (most likely a double zigzag). A simple 3 wave structure for wave A, followed by a complex structure for wave B, fits the guideline for a flat or expanded flat quite well.

Gas prices at the pump will follow crude oil higher into the business cycle high point. The trend is already being recognized by the mainstream media, as gas prices have jumped to $3.53 a gallon (US average) with prices already as high as $4.25 a gallon on the West Coast. Although the mainstream media is expecting gas prices at the pump to hit $4.25 a gallon (US average) later this year, one must account for the scenario of crude oil reaching the $135.50 - $170 a barrel target. Factoring the higher crude oil prices that will unfold in the near future, there is a high probability that gas prices at the pump will hit $5 a gallon in much of the United States, with gas prices going as high as $6 a gallon on the west coast of California. Rising gas prices should act to bring about a fast and abrupt reversal in the job creation trend as businesses will likely take a big hit from rising transportation costs.

After the high is put in for the year, Primary wave [C] down will follow, resulting in a resumption of a deflationary spiral in crude oil prices, eventually creating an economic environment where production of oil from tar sands, shale, and deep sea drilling is no longer economically viable.

Since everything moves together in a deflationary environment ("All the same market"), crude oil futures will remain at depressed levels after the flat or expanded flat structure is completed, which is expected to be Cycle wave w of Supercycle wave (a). Here is a long-term chart of crude oil illustrating the outlook of crude oil during "The Great Deflation":

Cycle wave w is expected to be completed at the next business cycle low point in 2016 with a downside target of around $8 a barrel. With crude oil futures at depressed levels for a number of years, Big Oil will inevitably shut down production of oil from tar sands, deep sea drilling, and shale, in order to protect their profits. The result of a mass shutdown in oil production will result in a 75% reduction in oil supply, causing an oil supply crash in 2017.

The oil supply crash is one of the defining characteristics of the coming Bachmann Administration Period (2017 - 2024). The result of an oil supply crash is that economic and living conditions on "Main Street" will return to the level of the 1930s. The oil supply crash will also play a substantial role in the implosion of 90% of corporations and businesses on the planet since goods can no longer get transported long distances. The economy will become increasingly local. Mom and pop businesses will return to the forefront as corporations shatter like glass. Family farms and farmers markets will make a strong comeback as corporate farms shut down from being unable to transport their finished goods long distances due to an oil supply shortage.

Saturday, February 11, 2012

Update on Our Current Position

The markets are still telling us that we are in a Grand Supercycle degree bear market, and therefore in a major depression in the economy. However, there is still a lot of exuberant optimism that has to be overcome before the markets can head decisively lower, as the (more complex than first thought) peaking process is indicating.

So far, most of the damage has unfolded behind the scenes, and it will continue to be the case for many more years before the bottom finally falls out. While the markets and the economy may appear to be healthy on the outside, there is already a lot of rot on the inside:

1 -- Bull markets rise not only in nominal terms, but in terms of purchasing power and in terms of real money (gold). In a bull market, the DJIA / gold ratio confirms the nominal DJIA. The DJIA / gold ratio peaked at around 45.8 in late 1999, just before the nominal DJIA put in its orthodox top in January 2000. While the nominal DJIA remains at elevated levels, the DJIA / gold reached a new low of 5.8 on October 2011 for a decline of 87% from the peak in real terms. The trend in the DJIA / gold ratio is clearly down. Neither the rally from 2002 - 2007 or the current rally from the March 2009 low are confirmed by the DJIA / gold ratio, so both must be characterized as bear market rallies regardless of how far the rally gets. The rally from the March 2009 low is not an impulse, since the DJIA / gold ratio is not confirming the move.

Here is an updated chart of the DJIA / gold ratio in the last three years:

2 -- The economy peaked in 2000 in terms of purchasing power (real GDP). The nominal GDP continues to hit new highs with a 2.8% annual rate of growth in the last quarter of 2011. The continued rise in nominal GDP reflects a relentless devaluation of the dollar, rather than real economic growth, as people, governments, corporations, and businesses become leveraged to the hilt with credit and debt. To get the actual inflation numbers, and thus the actual real GDP numbers, we go to the Shadow Government Statistics website, and use the numbers to generate a chart of the real GDP over time.

Here is the updated chart of the real GDP of the United States economy:

Without the distorting effect of government manipulation of the economic numbers, there would be no question at all that a major depression is unfolding. The bear market has already erased 17 years of economic growth as the United States economy now produces the same amount of goods and services as it did in 1983.

3 -- Job Market fundamentals continue to weaken. The economy was actually creating family wage jobs all the way up to the Grand Supercycle degree peak in 2000. The US economy stopped creating family wage jobs in 2000 and stopped creating living wage jobs in 2007. The trend of job creation that has been unfolding during the Obama Administration Period is primarily driven by the continued purging of full time workers (that are paid a living wage with benefits) and replacing them with temporary workers that are paid minimum wage with no benefits, creating a larger version of the phony Texas Miracle that unfolded while Rick Perry was the state's governor. The Unites States is more plutocratic now than it was during the Bush 43 Administration Period as the chasm between the top 1% and the working class continues to widen.

4 -- The stock market is currently in the midst of a (more complex than first thought) topping process. The major depression is currently unfolding in a punctuated fashion, as with the bear market and "The Great Deflation". Instead of a simple expanded flat for Supercycle wave (a), we are now dealing with a complex structure. A longer and more complex topping process means that the Federal Reserve, along with the Obama Administration (2009 - 2016) and the Bachmann Administration (2017 - 2024) will be able to keep the debt game going for quite a while longer before the bottom finally falls out and "The Great Deflation" unfolds in full force.

Here is a chart of the current rally from the March 2009 low. Since the DJIA / gold ratio is not confirming the move, the rally must be characterized as a bear market rally rather than an impulse. Also quite telling is volume and momentum, which also tell of a rally that is moving against the larger trend.

The rally from the March 2009 low is best characterized as a complex structure with a zigzag for W, an expanded flat for X, and a running triangle (notice the series of 3 wave moves off the October 2011 low) for Y. The end of the rally should correspond with a business cycle high point that is coming up in June 2012 with an upside target of 13750 for the DJIA and around 1440 for the S&P 500. The end of the rally completes the first subwave of Cycle wave x. The upside target should also adequately fulfill the Zweig Breadth Thrust signal as well.

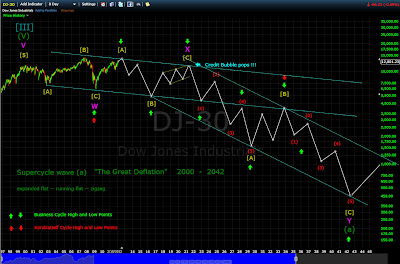

On the longer term, Supercycle wave (a) is unfolding as a complex structure, with Cycle wave w unfolding as an expanded flat, Cycle wave x unfolding as a running flat, and Cycle wave y unfolding as a zigzag. Here is a chart showing the complex structure:

Business cycle and Kondratieff Cycle high and low points are utilized to identify important junctures in the stock market. Even in a major depression, both are still operating -- a major depression would typically have 12 to 18 business cycles.

With each bubble that pops, the foundation holding up the house of (credit) cards weakens. Once the last bubble (which should be the credit bubble) pops, the bottom falls out and "The Great Deflation" starts unfolding in full force. The critical event should correspond with the end of Cycle wave x in 2021 (the next business cycle high point). Notice the steeper slope of the trend channels associated with the zigzag that starts unfolding in 2021. The house of (credit) cards is so large that it will take a very long time to fully collapse once the bottom falls out -- thus the 21 year duration for Cycle wave y. The end of "The Great Deflation" corresponds with yet another Business cycle low point in 2042.

The start of Cycle wave w to the end of Cycle wave x is a fibonacci 21 years.

Cycle wave y lasts a fibonacci 21 years.

The complex structure of Supercycle wave (a) rules out a triangle for Grand Supercycle wave [IV], since triangles almost always have a complex leg in either wave C or wave D. The preferred scenario is for Grand Supercycle wave [IV] to unfold as a flat. Since Supercycle wave (a) is the complex subwave, then the general guideline for a flat in this case is for Supercycle wave (b) to unfold as a simple zigzag. Supercycle wave (c) would then unfold as a 5 wave structure and end just beyond the end of Supercycle wave (a) with a downside target of 250, to be reached in 2118 -- a Kondratieff cycle low point. The downside target also fulfills another important Elliott Wave guideline, namely that Grand Supercycle wave [IV] achieves the target range of the fourth wave of one lesser degree, the levels that the stock market was at during the Great Depression.

Here is the chart showing all of Grand Supercycle wave [IV]:

The major depression is expected to unfold in three phases, as follows:

A 4000 year historical perspective indicates that a major depression typically has a duration of 80 - 120 years, so the 118 year duration that is proposed here is quite reasonable. We are still going through a complex topping process in which there is a massive blizzard of cheap credit thrown into the financial markets to keep the house of (credit) cards intact for as long as possible. The topping process should end in 2021 when the last of the bubbles pop. A critical technical breakdown in the stock market should occur in 2025 when the trend line connecting the 2002 and 2009 lows is broken.

So far, most of the damage has unfolded behind the scenes, and it will continue to be the case for many more years before the bottom finally falls out. While the markets and the economy may appear to be healthy on the outside, there is already a lot of rot on the inside:

1 -- Bull markets rise not only in nominal terms, but in terms of purchasing power and in terms of real money (gold). In a bull market, the DJIA / gold ratio confirms the nominal DJIA. The DJIA / gold ratio peaked at around 45.8 in late 1999, just before the nominal DJIA put in its orthodox top in January 2000. While the nominal DJIA remains at elevated levels, the DJIA / gold reached a new low of 5.8 on October 2011 for a decline of 87% from the peak in real terms. The trend in the DJIA / gold ratio is clearly down. Neither the rally from 2002 - 2007 or the current rally from the March 2009 low are confirmed by the DJIA / gold ratio, so both must be characterized as bear market rallies regardless of how far the rally gets. The rally from the March 2009 low is not an impulse, since the DJIA / gold ratio is not confirming the move.

Here is an updated chart of the DJIA / gold ratio in the last three years:

2 -- The economy peaked in 2000 in terms of purchasing power (real GDP). The nominal GDP continues to hit new highs with a 2.8% annual rate of growth in the last quarter of 2011. The continued rise in nominal GDP reflects a relentless devaluation of the dollar, rather than real economic growth, as people, governments, corporations, and businesses become leveraged to the hilt with credit and debt. To get the actual inflation numbers, and thus the actual real GDP numbers, we go to the Shadow Government Statistics website, and use the numbers to generate a chart of the real GDP over time.

Here is the updated chart of the real GDP of the United States economy:

Without the distorting effect of government manipulation of the economic numbers, there would be no question at all that a major depression is unfolding. The bear market has already erased 17 years of economic growth as the United States economy now produces the same amount of goods and services as it did in 1983.

3 -- Job Market fundamentals continue to weaken. The economy was actually creating family wage jobs all the way up to the Grand Supercycle degree peak in 2000. The US economy stopped creating family wage jobs in 2000 and stopped creating living wage jobs in 2007. The trend of job creation that has been unfolding during the Obama Administration Period is primarily driven by the continued purging of full time workers (that are paid a living wage with benefits) and replacing them with temporary workers that are paid minimum wage with no benefits, creating a larger version of the phony Texas Miracle that unfolded while Rick Perry was the state's governor. The Unites States is more plutocratic now than it was during the Bush 43 Administration Period as the chasm between the top 1% and the working class continues to widen.

4 -- The stock market is currently in the midst of a (more complex than first thought) topping process. The major depression is currently unfolding in a punctuated fashion, as with the bear market and "The Great Deflation". Instead of a simple expanded flat for Supercycle wave (a), we are now dealing with a complex structure. A longer and more complex topping process means that the Federal Reserve, along with the Obama Administration (2009 - 2016) and the Bachmann Administration (2017 - 2024) will be able to keep the debt game going for quite a while longer before the bottom finally falls out and "The Great Deflation" unfolds in full force.

Here is a chart of the current rally from the March 2009 low. Since the DJIA / gold ratio is not confirming the move, the rally must be characterized as a bear market rally rather than an impulse. Also quite telling is volume and momentum, which also tell of a rally that is moving against the larger trend.

The rally from the March 2009 low is best characterized as a complex structure with a zigzag for W, an expanded flat for X, and a running triangle (notice the series of 3 wave moves off the October 2011 low) for Y. The end of the rally should correspond with a business cycle high point that is coming up in June 2012 with an upside target of 13750 for the DJIA and around 1440 for the S&P 500. The end of the rally completes the first subwave of Cycle wave x. The upside target should also adequately fulfill the Zweig Breadth Thrust signal as well.

On the longer term, Supercycle wave (a) is unfolding as a complex structure, with Cycle wave w unfolding as an expanded flat, Cycle wave x unfolding as a running flat, and Cycle wave y unfolding as a zigzag. Here is a chart showing the complex structure:

Business cycle and Kondratieff Cycle high and low points are utilized to identify important junctures in the stock market. Even in a major depression, both are still operating -- a major depression would typically have 12 to 18 business cycles.

With each bubble that pops, the foundation holding up the house of (credit) cards weakens. Once the last bubble (which should be the credit bubble) pops, the bottom falls out and "The Great Deflation" starts unfolding in full force. The critical event should correspond with the end of Cycle wave x in 2021 (the next business cycle high point). Notice the steeper slope of the trend channels associated with the zigzag that starts unfolding in 2021. The house of (credit) cards is so large that it will take a very long time to fully collapse once the bottom falls out -- thus the 21 year duration for Cycle wave y. The end of "The Great Deflation" corresponds with yet another Business cycle low point in 2042.

The start of Cycle wave w to the end of Cycle wave x is a fibonacci 21 years.

Cycle wave y lasts a fibonacci 21 years.

The complex structure of Supercycle wave (a) rules out a triangle for Grand Supercycle wave [IV], since triangles almost always have a complex leg in either wave C or wave D. The preferred scenario is for Grand Supercycle wave [IV] to unfold as a flat. Since Supercycle wave (a) is the complex subwave, then the general guideline for a flat in this case is for Supercycle wave (b) to unfold as a simple zigzag. Supercycle wave (c) would then unfold as a 5 wave structure and end just beyond the end of Supercycle wave (a) with a downside target of 250, to be reached in 2118 -- a Kondratieff cycle low point. The downside target also fulfills another important Elliott Wave guideline, namely that Grand Supercycle wave [IV] achieves the target range of the fourth wave of one lesser degree, the levels that the stock market was at during the Great Depression.

Here is the chart showing all of Grand Supercycle wave [IV]:

The major depression is expected to unfold in three phases, as follows:

Supercycle wave (a) -- "The Great Deflation" (economic cataclysm) 2000 - 2042

Supercycle wave (b) -- Green Technology Age 2042 - 2076

Supercycle wave (c) -- "The Great Tribulation" (social cataclysm) 2076 - 2118

A 4000 year historical perspective indicates that a major depression typically has a duration of 80 - 120 years, so the 118 year duration that is proposed here is quite reasonable. We are still going through a complex topping process in which there is a massive blizzard of cheap credit thrown into the financial markets to keep the house of (credit) cards intact for as long as possible. The topping process should end in 2021 when the last of the bubbles pop. A critical technical breakdown in the stock market should occur in 2025 when the trend line connecting the 2002 and 2009 lows is broken.

Tuesday, February 7, 2012

Collapse of Mitt Romney in Progress

Mitt Romney's candidacy is collapsing, exactly as I suggested in an earlier post. Mitt Romney's performance in the GOP Primaries and caucuses is unfolding exactly as forecast. As the polls in Missouri, Minnesota, and Colorado closed, Rick Santorum was declared the projected winner immediately after the polls closed. This falls in line with an earlier forecast made back in December 2011, indicating that success will become increasingly difficult for Mitt Romney over time during the time that the second wave of states go through the process of voting for the GOP nominee.

In spite of the nominal DJIA taking out last years high, The DJIA continues to decline from the Minor degree peak in late December 2011 in terms of real money -- the DJIA / gold ratio. The DJIA / gold ratio, known as the "real Dow", has proven to be an excellent indicator for forecasting the fortunes of people in the political arena. Here is an updated chart of the DJIA / gold ratio:

While the Primary wave [3] down count in the nominal DJIA was effectively invalidated, the scenario is still playing out strong in the DJIA / gold ratio -- the "real Dow", indicating that social mood has been deteriorating since the start of the new year. New charts with updated wave counts are coming in the future once the "lay of the land" is reasonably re-assessed. The DJIA / gold ratio is down around 85% from the peak in 1999, while the nominal DJIA is still at elevated levels -- this is indicative of governments, corporations, businesses, and even individuals getting leveraged to the hilt with credit and debt as a massive blizzard of cheap credit continues to expand an over-bloated credit bubble that is now 38 years old.

Mitt Romney's candidacy is collapsing, and the collapse has only begun. As the second wave of states in the GOP Primary go through the process of voting for their preferred candidate, Mitt Romney is expected to continue losing steam, leading to a disappointing performance in Super Tuesday. If Rick Santorun continues winning states in the coming weeks and days as the DJIA / gold ratio goes south, he will eventually be able to claim the nomination outright on Super Tuesday.

In spite of the nominal DJIA taking out last years high, The DJIA continues to decline from the Minor degree peak in late December 2011 in terms of real money -- the DJIA / gold ratio. The DJIA / gold ratio, known as the "real Dow", has proven to be an excellent indicator for forecasting the fortunes of people in the political arena. Here is an updated chart of the DJIA / gold ratio:

While the Primary wave [3] down count in the nominal DJIA was effectively invalidated, the scenario is still playing out strong in the DJIA / gold ratio -- the "real Dow", indicating that social mood has been deteriorating since the start of the new year. New charts with updated wave counts are coming in the future once the "lay of the land" is reasonably re-assessed. The DJIA / gold ratio is down around 85% from the peak in 1999, while the nominal DJIA is still at elevated levels -- this is indicative of governments, corporations, businesses, and even individuals getting leveraged to the hilt with credit and debt as a massive blizzard of cheap credit continues to expand an over-bloated credit bubble that is now 38 years old.

Mitt Romney's candidacy is collapsing, and the collapse has only begun. As the second wave of states in the GOP Primary go through the process of voting for their preferred candidate, Mitt Romney is expected to continue losing steam, leading to a disappointing performance in Super Tuesday. If Rick Santorun continues winning states in the coming weeks and days as the DJIA / gold ratio goes south, he will eventually be able to claim the nomination outright on Super Tuesday.

Saturday, February 4, 2012

Climax of Exuberant Bullishness

It's all led up to the main event -- a climaxing of exuberant bullishness as the peak of Minor wave 2 is established. With markets continuing to rally throughout January 2012 on decreasing momentum and volume, exuberant bullishness continued to build to levels that few even thought possible. The reprieve period was originally expected to last 3 months with the markets doing a relatively standard 61.8% retrace of Minor wave 1 down, bringing the DJIA back up to 11930 and the S&P 500 back up to 1260 by early January 2012.

By late October 2011, bullishness started to make a return as we completed the first part of Minor wave 2 up. The peak of Minute wave [w] of Minor wave 2 up occurred on good news -- namely the European debt crisis going into remission when a deal was made in which banks took a 50% haircut on Greek debt. The rally off the early October 2011 low was so powerful that it triggered a Zweig Breadth Thrust signal.

Short term bearish sentiment started to return during Minute wave [x] of Minor wave 2 up, which unfolded during most of November 2011. Bear market rallies can be riddled full of pitfalls, and this one was no exception as many pitfalls showed up in November 2011 with rising interest rates in Italian, Spanish, and French bonds, mass crackdowns on Occupy Wall Street protesters by police, and the SOPA bill (now dead) moving through Congress at that time.

The last part of Minor wave 2 up was kicked off by a mass intervention of multiple central banks with the aim of shoring up liquidity. The DJIA shot up almost 500 points shortly before the intervention started and kicked off a massive wave of exuberant bullishness. In early December 2011, bullishness became dominant again with economists, analysts, and the mainstream media getting bullish on the economy and the job market.

By late December 2011, expectations for a three month long reprieve period were fulfilled. Throughout the course of Minute wave [y] of Minor wave 2 up, there was increasing bullishness with increasing calls for more bull market, more economic recovery, and more job creation. Calls for the stock market to take out the 2007 highs were routinely unfolding as analysts became more optimistic under the influence of rising social mood. A waterfall decline was originally expected to start in January 2012, yet even as the reprieve period continued to go into overtime in January 2012, momentum and volume continued to weaken over time as the markets continued to float higher, continuing to signal that a sharp decline is ahead.

By late January 2012, extreme bullish sentiment was taken to the next level as capitulation started to set in. People that have been bearish were throwing in the towel as the markets continued to slowly float higher. The fortitude of even the most staunch of bears was being tested all the way to the core as the markets closed in on 12876 on the DJIA, 1370 on the S&P 500 and 14562 on the Wilshire 5000. Virtually everyone was convinced that the markets could only go up.

The last part of January 2012 marked the beginning of the climax as the mainstream media devoted an insane amount of time to the Facebook IPO as anticipation shot up into the stratosphere. From a socionomic perspective, there was a great deal of significance to the developments associated with the Facebook IPO as Minor wave 2 neared completion. This was Facebook's mountain top experience unfolding, much like Apple with its blowout earnings earlier in the month.

The climax of extreme bullish sentiment came with the jobs report that came out yesterday. It wasn't the rate of job creation or the official unemployment rate (U-3) that resulted in the reaction from the mainstream media and economists, for the economy was also creating jobs at the same rate in the first few months of last year. The mainstream media devoted around the clock coverage on the jobs report and the job market (a type of event that almost never occurs). Virtually everyone is convinced that the job market recovery will continue to unfold. As a testimony of the extensive news coverage devoted to the jobs report, there was coverage on Hardball with Chris Matthews, Nightly News with Brian Williams, the Rachel Maddow show, and CNBC. The markets shot up in an exhaustion gap in the morning hours before the jobs report was released and continued higher through the morning hours. The DJIA came within 6 points of hitting the May 2011 high before going lower and sideways for the rest of the trading session. Bullish sentiment climaxed as > 99% of analysts are strongly convinced of the inevitability of new highs in the stock market, as well as > 99% of economists and analysts convinced that the economy and job market can only go up. Exuberant bullishness has indeed reached an epic climax. From a socionomic perspective, such an event is a signal of a large degree peak with a reversal in the stock market, economy, and job market just around the corner.

The last time that exuberant bullishness climaxed was in May 2011 with the news of the assassination of Osama bin Laden. The event marked the peak of Primary wave [2] up and President Obama's approval rating briefly reached 61% in the aftermath of the event. After the event took place, markets declined, unfolding as Minor wave 1 down within a much larger Primary degree downward impulse.

Increasing hard times are in the forecast for 2012 as we enter Minor wave 3 down in a matter of a few days at the most if we are not there already. The Minor degree bear market rally for the Wilshire 5000, the S&P 500, and the DJIA all appear to be complete.

By late October 2011, bullishness started to make a return as we completed the first part of Minor wave 2 up. The peak of Minute wave [w] of Minor wave 2 up occurred on good news -- namely the European debt crisis going into remission when a deal was made in which banks took a 50% haircut on Greek debt. The rally off the early October 2011 low was so powerful that it triggered a Zweig Breadth Thrust signal.

Short term bearish sentiment started to return during Minute wave [x] of Minor wave 2 up, which unfolded during most of November 2011. Bear market rallies can be riddled full of pitfalls, and this one was no exception as many pitfalls showed up in November 2011 with rising interest rates in Italian, Spanish, and French bonds, mass crackdowns on Occupy Wall Street protesters by police, and the SOPA bill (now dead) moving through Congress at that time.

The last part of Minor wave 2 up was kicked off by a mass intervention of multiple central banks with the aim of shoring up liquidity. The DJIA shot up almost 500 points shortly before the intervention started and kicked off a massive wave of exuberant bullishness. In early December 2011, bullishness became dominant again with economists, analysts, and the mainstream media getting bullish on the economy and the job market.

By late December 2011, expectations for a three month long reprieve period were fulfilled. Throughout the course of Minute wave [y] of Minor wave 2 up, there was increasing bullishness with increasing calls for more bull market, more economic recovery, and more job creation. Calls for the stock market to take out the 2007 highs were routinely unfolding as analysts became more optimistic under the influence of rising social mood. A waterfall decline was originally expected to start in January 2012, yet even as the reprieve period continued to go into overtime in January 2012, momentum and volume continued to weaken over time as the markets continued to float higher, continuing to signal that a sharp decline is ahead.

By late January 2012, extreme bullish sentiment was taken to the next level as capitulation started to set in. People that have been bearish were throwing in the towel as the markets continued to slowly float higher. The fortitude of even the most staunch of bears was being tested all the way to the core as the markets closed in on 12876 on the DJIA, 1370 on the S&P 500 and 14562 on the Wilshire 5000. Virtually everyone was convinced that the markets could only go up.

The last part of January 2012 marked the beginning of the climax as the mainstream media devoted an insane amount of time to the Facebook IPO as anticipation shot up into the stratosphere. From a socionomic perspective, there was a great deal of significance to the developments associated with the Facebook IPO as Minor wave 2 neared completion. This was Facebook's mountain top experience unfolding, much like Apple with its blowout earnings earlier in the month.

The climax of extreme bullish sentiment came with the jobs report that came out yesterday. It wasn't the rate of job creation or the official unemployment rate (U-3) that resulted in the reaction from the mainstream media and economists, for the economy was also creating jobs at the same rate in the first few months of last year. The mainstream media devoted around the clock coverage on the jobs report and the job market (a type of event that almost never occurs). Virtually everyone is convinced that the job market recovery will continue to unfold. As a testimony of the extensive news coverage devoted to the jobs report, there was coverage on Hardball with Chris Matthews, Nightly News with Brian Williams, the Rachel Maddow show, and CNBC. The markets shot up in an exhaustion gap in the morning hours before the jobs report was released and continued higher through the morning hours. The DJIA came within 6 points of hitting the May 2011 high before going lower and sideways for the rest of the trading session. Bullish sentiment climaxed as > 99% of analysts are strongly convinced of the inevitability of new highs in the stock market, as well as > 99% of economists and analysts convinced that the economy and job market can only go up. Exuberant bullishness has indeed reached an epic climax. From a socionomic perspective, such an event is a signal of a large degree peak with a reversal in the stock market, economy, and job market just around the corner.

The last time that exuberant bullishness climaxed was in May 2011 with the news of the assassination of Osama bin Laden. The event marked the peak of Primary wave [2] up and President Obama's approval rating briefly reached 61% in the aftermath of the event. After the event took place, markets declined, unfolding as Minor wave 1 down within a much larger Primary degree downward impulse.

Increasing hard times are in the forecast for 2012 as we enter Minor wave 3 down in a matter of a few days at the most if we are not there already. The Minor degree bear market rally for the Wilshire 5000, the S&P 500, and the DJIA all appear to be complete.

Wednesday, February 1, 2012

Facebook's Mountaintop Experience

There has been a tremendous amount of buzz surrounding the much anticipated Facebook IPO over the last several weeks. Today, Facebook has filed for a $5 billion IPO under the symbol FB. It is very significant that Facebook is filing for an IPO while the peak of Minor wave 2 up is unfolding in the S&P 500 and the Wilshire 5000.

From a socionomic perspective, the timing of Facebook's IPO could be signalling a large degree peak in the stock market with another wave of bearish social mood to follow in the near future. It could also be signalling a peak for Facebook as well, given the insane amount of news coverage in the mainstream media that the IPO has been getting, and the insane amount of anticipation for the IPO as well.

Facebook formed in 2004 and its rise from start-up to a large corporation was very rapid, reaching 500 million users by 2010 and over 700 million today. Facebook was featured in the movie The Social Network in 2010, with the movie opening in theaters in October 2010.

There was an insane amount of anticipation for the Facebook IPO:

1 -- Facebook IPO: What to Expect --- ABC News.

2 -- Facebook plans IPO filing as early as next week -- Jan 27, 2012, Bloomberg

3 -- What to expect from Facebook's IPO filing -- Washington Post

4 -- Facebook may file for IPO this week -- USA Today

There has also been a lot of exuberant bullishness on the potential impact of Facebook's IPO on Wall Street as well:

1 -- Silicon Valley braces for Facebook millionaires -- Yahoo news

2 -- Why Facebook IPO is a bonanza for Wall Street -- CNBC

3 -- Facebook IPO will create a money machine -- Forbes

Given the insane amount of news coverage that Facebook is getting on its IPO, coupled with the exuberant bullishness on the stock market that is still present, Facebook could be approaching a large degree peak.

"Mountain-top experiences" can unravel very quickly, and Facebook could be in for quite a large fall when social mood starts becoming increasingly bearish in earnest as indicated in the DJIA, S&P 500 and the Wilshire 5000.

From a socionomic perspective, the timing of Facebook's IPO could be signalling a large degree peak in the stock market with another wave of bearish social mood to follow in the near future. It could also be signalling a peak for Facebook as well, given the insane amount of news coverage in the mainstream media that the IPO has been getting, and the insane amount of anticipation for the IPO as well.

Facebook formed in 2004 and its rise from start-up to a large corporation was very rapid, reaching 500 million users by 2010 and over 700 million today. Facebook was featured in the movie The Social Network in 2010, with the movie opening in theaters in October 2010.

There was an insane amount of anticipation for the Facebook IPO:

1 -- Facebook IPO: What to Expect --- ABC News.

2 -- Facebook plans IPO filing as early as next week -- Jan 27, 2012, Bloomberg

3 -- What to expect from Facebook's IPO filing -- Washington Post

4 -- Facebook may file for IPO this week -- USA Today

There has also been a lot of exuberant bullishness on the potential impact of Facebook's IPO on Wall Street as well:

1 -- Silicon Valley braces for Facebook millionaires -- Yahoo news

2 -- Why Facebook IPO is a bonanza for Wall Street -- CNBC

3 -- Facebook IPO will create a money machine -- Forbes

Given the insane amount of news coverage that Facebook is getting on its IPO, coupled with the exuberant bullishness on the stock market that is still present, Facebook could be approaching a large degree peak.

"Mountain-top experiences" can unravel very quickly, and Facebook could be in for quite a large fall when social mood starts becoming increasingly bearish in earnest as indicated in the DJIA, S&P 500 and the Wilshire 5000.

Subscribe to:

Posts (Atom)