So far, most of the damage has unfolded behind the scenes, and it will continue to be the case for many more years before the bottom finally falls out. While the markets and the economy may appear to be healthy on the outside, there is already a lot of rot on the inside:

1 -- Bull markets rise not only in nominal terms, but in terms of purchasing power and in terms of real money (gold). In a bull market, the DJIA / gold ratio confirms the nominal DJIA. The DJIA / gold ratio peaked at around 45.8 in late 1999, just before the nominal DJIA put in its orthodox top in January 2000. While the nominal DJIA remains at elevated levels, the DJIA / gold reached a new low of 5.8 on October 2011 for a decline of 87% from the peak in real terms. The trend in the DJIA / gold ratio is clearly down. Neither the rally from 2002 - 2007 or the current rally from the March 2009 low are confirmed by the DJIA / gold ratio, so both must be characterized as bear market rallies regardless of how far the rally gets. The rally from the March 2009 low is not an impulse, since the DJIA / gold ratio is not confirming the move.

Here is an updated chart of the DJIA / gold ratio in the last three years:

2 -- The economy peaked in 2000 in terms of purchasing power (real GDP). The nominal GDP continues to hit new highs with a 2.8% annual rate of growth in the last quarter of 2011. The continued rise in nominal GDP reflects a relentless devaluation of the dollar, rather than real economic growth, as people, governments, corporations, and businesses become leveraged to the hilt with credit and debt. To get the actual inflation numbers, and thus the actual real GDP numbers, we go to the Shadow Government Statistics website, and use the numbers to generate a chart of the real GDP over time.

Here is the updated chart of the real GDP of the United States economy:

Without the distorting effect of government manipulation of the economic numbers, there would be no question at all that a major depression is unfolding. The bear market has already erased 17 years of economic growth as the United States economy now produces the same amount of goods and services as it did in 1983.

3 -- Job Market fundamentals continue to weaken. The economy was actually creating family wage jobs all the way up to the Grand Supercycle degree peak in 2000. The US economy stopped creating family wage jobs in 2000 and stopped creating living wage jobs in 2007. The trend of job creation that has been unfolding during the Obama Administration Period is primarily driven by the continued purging of full time workers (that are paid a living wage with benefits) and replacing them with temporary workers that are paid minimum wage with no benefits, creating a larger version of the phony Texas Miracle that unfolded while Rick Perry was the state's governor. The Unites States is more plutocratic now than it was during the Bush 43 Administration Period as the chasm between the top 1% and the working class continues to widen.

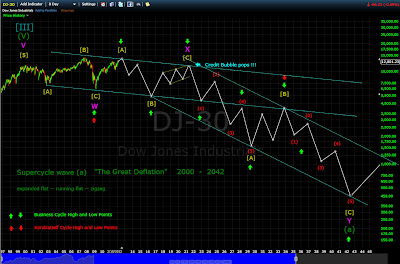

4 -- The stock market is currently in the midst of a (more complex than first thought) topping process. The major depression is currently unfolding in a punctuated fashion, as with the bear market and "The Great Deflation". Instead of a simple expanded flat for Supercycle wave (a), we are now dealing with a complex structure. A longer and more complex topping process means that the Federal Reserve, along with the Obama Administration (2009 - 2016) and the Bachmann Administration (2017 - 2024) will be able to keep the debt game going for quite a while longer before the bottom finally falls out and "The Great Deflation" unfolds in full force.

Here is a chart of the current rally from the March 2009 low. Since the DJIA / gold ratio is not confirming the move, the rally must be characterized as a bear market rally rather than an impulse. Also quite telling is volume and momentum, which also tell of a rally that is moving against the larger trend.

The rally from the March 2009 low is best characterized as a complex structure with a zigzag for W, an expanded flat for X, and a running triangle (notice the series of 3 wave moves off the October 2011 low) for Y. The end of the rally should correspond with a business cycle high point that is coming up in June 2012 with an upside target of 13750 for the DJIA and around 1440 for the S&P 500. The end of the rally completes the first subwave of Cycle wave x. The upside target should also adequately fulfill the Zweig Breadth Thrust signal as well.

On the longer term, Supercycle wave (a) is unfolding as a complex structure, with Cycle wave w unfolding as an expanded flat, Cycle wave x unfolding as a running flat, and Cycle wave y unfolding as a zigzag. Here is a chart showing the complex structure:

Business cycle and Kondratieff Cycle high and low points are utilized to identify important junctures in the stock market. Even in a major depression, both are still operating -- a major depression would typically have 12 to 18 business cycles.

With each bubble that pops, the foundation holding up the house of (credit) cards weakens. Once the last bubble (which should be the credit bubble) pops, the bottom falls out and "The Great Deflation" starts unfolding in full force. The critical event should correspond with the end of Cycle wave x in 2021 (the next business cycle high point). Notice the steeper slope of the trend channels associated with the zigzag that starts unfolding in 2021. The house of (credit) cards is so large that it will take a very long time to fully collapse once the bottom falls out -- thus the 21 year duration for Cycle wave y. The end of "The Great Deflation" corresponds with yet another Business cycle low point in 2042.

The start of Cycle wave w to the end of Cycle wave x is a fibonacci 21 years.

Cycle wave y lasts a fibonacci 21 years.

The complex structure of Supercycle wave (a) rules out a triangle for Grand Supercycle wave [IV], since triangles almost always have a complex leg in either wave C or wave D. The preferred scenario is for Grand Supercycle wave [IV] to unfold as a flat. Since Supercycle wave (a) is the complex subwave, then the general guideline for a flat in this case is for Supercycle wave (b) to unfold as a simple zigzag. Supercycle wave (c) would then unfold as a 5 wave structure and end just beyond the end of Supercycle wave (a) with a downside target of 250, to be reached in 2118 -- a Kondratieff cycle low point. The downside target also fulfills another important Elliott Wave guideline, namely that Grand Supercycle wave [IV] achieves the target range of the fourth wave of one lesser degree, the levels that the stock market was at during the Great Depression.

Here is the chart showing all of Grand Supercycle wave [IV]:

The major depression is expected to unfold in three phases, as follows:

Supercycle wave (a) -- "The Great Deflation" (economic cataclysm) 2000 - 2042

Supercycle wave (b) -- Green Technology Age 2042 - 2076

Supercycle wave (c) -- "The Great Tribulation" (social cataclysm) 2076 - 2118

A 4000 year historical perspective indicates that a major depression typically has a duration of 80 - 120 years, so the 118 year duration that is proposed here is quite reasonable. We are still going through a complex topping process in which there is a massive blizzard of cheap credit thrown into the financial markets to keep the house of (credit) cards intact for as long as possible. The topping process should end in 2021 when the last of the bubbles pop. A critical technical breakdown in the stock market should occur in 2025 when the trend line connecting the 2002 and 2009 lows is broken.

I like this site better before you lost your nerve. I agree with the whole debt crunch but the logic does not follow here. If the Dow hits 3000 points anytime soon, that no doubt includes the fact that all the banks in then market have MIT caps of zero. This is not a linear process things happen slower then you expect then faster then you thought possible. The co dependence of the system insures that once a some thing large breaks "Greece" the whole derivative debt debacle will come crashing down fast.

ReplyDeleteGreat stuff. On the first DJ-30 chart, your 2012 top projection of 13750 corresponds to September time frame, but the text says June. Was it a typo or maybe I am not reading correctly? I personally think the Sept time frame might be more realistic for this target.

ReplyDeleteI am looking at June 2012 as the peaking date for the rally off the March 2009 low. The first DJ-30 chart reflects the projected time frame (2 columns to the left of where the year 2013 starts, each column is 3 months).

DeleteJune 2012 is also a business cycle high point. Both the 2002 and 2009 lows correspond to a business cycle low point.