Facebook has reached the top of the mountain and is now on the other side of the mountain. The IPO was hyped into the stratosphere before debuting on May 20, 2012. The company's stock opened at $38 a share, whipsawed throughout the day before ending the first day up just 0.6%. In the days following the unveiling of the IPO, Facebook has seen its stock plunge in a waterfall decline and is now at $33 a share. It's too early to come up with a wave count for Facebook's stock, but being part of the Nasdaq and being part of the social media bubble that has either popped or will do so soon, the Nasdaq can be used as a reasonably good proxy for where Facebook will be heading down the road in the months and years ahead.

Facebook's mountain top experience was evident back in early February 2012 as rumors about an IPO began to circulate throughout the financial world. Facebook's population had reached 700 million at that time and has allegedly reached 900 million today. There was an insane amount of anticipation for the IPO back then as exuberant optimism went into overdrive. Several days ago, as the IPO was about to debut, it had become evident that Facebook was at the top of the mountain, yet the other side of the mountain was clearly visible. With Facebook changing its policies and terms of use on a frequent basis, the seeds of destruction have already been sown, evidenced by an AP-CNBC poll showing that 59% of Facebook users do not trust Facebook to keep their personal information private. With social mood poised to go south for several years, mistrust can easily turn into a scenario where people rush for the exits by the tens of millions as they pull the plug on their Facebook accounts out of anger and self preservation of their privacy, especially as we approach the year 2015, when Intermediate wave (Y) (the sharp zigzag down) of Primary wave [X] (2011 - 2016) down is in progress.

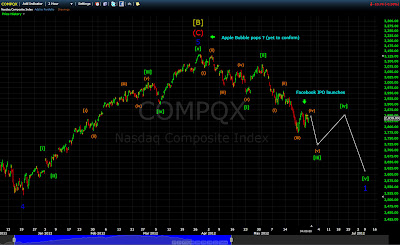

The Nasdaq is a reasonably good proxy for where Facebook is heading in the future as all the social media companies are part of the index. Here is an intermediate term chart of the Nasdaq with the Facebook IPO arrowed on the chart:

As the chart shows, the Nasdaq is already on the way down again, completing Primary wave [B] (2002 - 2012) of the zigzag Cycle wave w (2000 - 2016) with Primary wave [C] (2012 - 2016) now in progress. The Facebook IPO was unveiled during Minuette wave (iv) of Minute wave [iii] of Minor wave 1 down from the March 2012 peak in the Nasdaq. The future wave path of the Nasdaq also supports the idea of Facebook having peaked a few days ago with a long term decline on the horizon.

We are indeed seeing the beginning of the end of Facebook. In the immediate aftermath of the IPO, Facebook has run into hard times on many fronts:

1 -- Shareholders are now suing Facebook and its banking partners as a trading firm revealed massive losses on its shares and are seeking remedies. The sudden change in sentiment from hype to anger is a strong indication that social mood is going south on a large scale.

2 -- The Feds are probing a deal over Wall Street investment banks warning its top clients about Facebook's future financial prospects in the days leading up to the IPO as well as revelations involving Facebook's underwriters gave favored clients an unfair advantage over other investors. This is the first time that the Feds have gotten involved in an IPO debacle. Other social media companies, such as Pandora, had unveiled their IPOs and seen their stocks decline without drawing attention from the government. The involvement of the Feds also signals a major trend change in social mood.

3 -- The chairman of the Senate Banking Committee, Sen. Tim Johnson (D-SD), has indicated that his panel is looking into the Facebook IPO. The banking committee seeks briefings with Facebook's representatives, regulatory agencies, and possibly the banking underwriters, with the possibility of a hearing taking place in the short term future.

4 -- Facebook's top executives are exploiting loopholes to avoid paying taxes to the US government, as well as Facebook issuing stock options to avoid corporate taxes. This move was immediately denounced by Sen. Carl Levin (D-MI), highlighting the destructive effects of the exploits on the taxpayers and on US tax revenue.

5 -- Citadel Investment Group took massive losses from Facebook trades on the behalf of clients, again underscoring the hype surrounding the IPO which did not materialize into gains for investors.

In spite of the massive decline in Facebook's stock following the IPO debut, as well as the hard times that have now started to come to the company, analysts and economists are still stubbornly optimistic on the prospects of Facebook's stock going higher in the future. Setting the scene is analyst Laura Martin of Needham & Co, who went on CNBC comparing the idea of shorting Facebook stock to "getting in front of a freight train" and issued a "buy" rating for Facebook stock.

Facebook's hard times are just beginning. We are seeing the initial series of shocks now. As social mood goes south in the months and years to come, Facebook's decline will continue unabated, eventually resulting in tens of millions of people rushing for the exits as mistrust morphs into anger and self preservation in the area of protecting their privacy and personal information. Facebook is expected to be much smaller in 2016 than it is now with a population decline of 50% of more from today's levels.

No comments:

Post a Comment